Past SSF Events 2022

Select an event in the table below and find out more about the events SSF organised in 2022.

SSF-GCNLS TNFD Framework v0.3 Webinar

In this joint webinar from Swiss Sustainable Finance (SSF) and UN Global Compact Network Switzerland and Liechtenstein (GCNLS), Fabienne Sigg, Programme Manager, GCNLS, and Veronica Baker, Project Manager, SSF introduced our combined network to Swiss consultation group for the TNFD and gave an overview of the TNFD framework in general. Then, Nathalie Borgeaud, lead, Financial Markets Engagement, TNFD, shared the newest release of the TNFD framework version 0.3 and started the discussion that will continue in a subsequent workshop (taking place in January 2023) with selected individuals to give feedback in time for the next version.

Please find the presentations and the recording available in the Members' Section.

Members' Webinar: SSF/EY Practitioners’s Guide: Practical insights on the integration of sustainability preferences into the advisory process for private clients

In July 2022 SSF and EY published a Practitioners’ Guide on the integration of sustainability preferences into the advisory process for private clients. The report aims to shed light on and provide solutions for the risk that clients can be consciously or unconsciously misled about the sustainability characteristics of financial instruments and services, resulting in expectation gaps. This webinar Katja Brunner (SSF) and Stephan Geiger (EY) summarized the main findings and outlined the recommendations. In addition, guest speakers, Rosa Sangiorgio (Pictet Wealth Management) and Erol Bilecen (Raiffeisen) provided insights on the practical implementation of the recommendations.

Members can access the webinar materials in the members' section of our website.

Members' Webinar: EU-Regulation: State of play, challenges and outlook (Taxonomy, SFDR, CSRD, MiFID II)

Members can access the webinar materials in the members' section of our website.

Second SSF Annual Forum for Sustainable Finance Education

This event was held on 8 November 2022 in Zurich in German at the Renaissance Zurich Tower Hotel and on 9 November in Geneva in French at the Warwick Hotel. The annual forum aims to bring together professionals from the sustainable finance education field. The special focus of the event was on the current and future needs of for sustainable finance education.

Please find the presentations from Geneva and Zurich below:

SSF/ZHAW Novel Data Solutions: Big Data and AI for Sustainable Investing - from Biodiversity Risks to Sustainable Gold

As part of a networking series on Novel Data Solutions, SSF and ZHAW hosted an event centering big data and AI. This event opened with a welcome from Dr. Tomasz Orpiszewski and Sabine Döbeli, followed by a keynote speech on Measuring the State of Nature from Dr. Oliver Schelske, Natural Assets and ESG Research Lead, Swiss Re Management Ltd.

The rest of the event was divided into three thematic sections, followed by a panel discussion. The first thematic section lookied at biodiversity risks and featured presentations by Romie Goedicke, Technical and Project Manager Nature, UNEP FI, Julia Armstrong D'Agnese and Frank A. D'Agnese, President and CTO of Earth Knowledge, David J Patterson, Head Conservation Intelligence, WWF Sight and Pierrick Poulenas, CEO at Picterra.

The second section centered biodiversity impacts and sustainable gold. This featured presentations by Sabrina Karib, Founder of Precious Metals Impact Forum, Urs Röösli from aXedras AG, Ben Hobson, Programme Officer, IBAT, Prof Dr. Alexander Damm-Reiser and Dr. Patrick Laube, ZHAW geoinformatics.

The third section presented sustainable investing and how novel data solutions can be applied. This was explored in presentations by Dr. Tomasz Orpiszewski, Senior Lecturer at ZHAW, Dr. Mark Thompson, Senior Researcher at ZHAW, Dr. tingyu Yu, Universität Zürich, Prof. Martin Hillebrand, Professor for Quantitative Methods, XU Exponential University and David Jaggi, Researcher, ZHAW.

The panel, moderated by Sabine Döbeli, discussed the role of finance to protect natural resorces and centered the importance of immediate action to conserve biodiversity and how currently available data can support this urgent action. The panel featured Eva Heijkants, Client Relations, Sustainalytics, Morgan Williams, SI Data Strategist, Robeco and Judson Berkey, MD, Head Engagement and Regulatory Strategy, UBS and Member of TNFD Taskforce.

- Oliver Schelske slidedeck

- Romie Goedicke slidedeck

- Julia Armstrong D'Agnese and Frank A. D'Agnese slidedeck

- David J Patterson slidedeck

- Frank de Morsier slidedeck

- Sabrina Karib slidedeck

- Urs Röösli slidedeck

- Ben Jobson slidedeck

- Alexander Damm-Reiser and Patrick Laube slidedeck

- Tomasz Orpiszewski slidedeck

- Mark Thompson slidedeck

- Tingyu Yu slidedeck

- Martin Hillebrand slidedeck

- David Jaggi slidedeck

SFI/SSF Sustainable Finance Conference: How Finance Enables Positive Change

As part of the Building Bridges Community, the joint event of the Swiss Finance Institute (SFI) and SSF discussed topics on governance and regulation as also sustainable investing and financing. The speakers critically reflected on sustainable companies in crisis scenarios and against the backdrop of recent political and economic developments. Furthermore, the event shed light into sustainable investing on a global and Swiss level as also corporate actions towards sustainability including considerations of HR management. Concluded by a high-level panel the various topics provided ground for future discussions on positively influencing the economy.

Building Bridges Week 2022: 4 SSF events

Building Bridges 2022 is the third iteration of a joint initiative, launched in 2019 by Swiss public authorities, the finance community, the United Nations and other International partners to accelerate the transition to a global economic model aligned with the SDGs.

4 October, 16:00-18:30 - Innovative Blended Finance Solutions for Impact

During this session, players came together to discuss innovative blended finance solutions and how they can be replicated and scaled to reach end beneficiaries in underserved communities. The event also provided an update on the SDG Impact Finance Initiative (SIFI) launched at last year’s Building Bridges week in 2021. After opening remarks from Dominique Paravicini, Head of the Economic Cooperation and Development Division, SECO, Sabine Döbeli, CEO, SSF, moderated a panel of experts sharing their experiences in the blended finance space. Marco Serena, Head of Impact and Strategy, PIDG, Kruskaia Sierra-Escalante, Senior Manager for Blended Finance, IFC and Leticia Ferreras Astorqui, Development Finance Team, Allianz GI, outlined their organisations’ roles in building up blended finance solutions, highlighting key aspects such as how to attract “patient finance”, challenges around project affordability vs acceptable returns, correctly pricing in the value generated by individual projects, dealing with issues around the inherent highly structured nature of blended solutions and promoting adequate reporting by investees.

Christian Frutiger, SDC, transitioned into the second half of the event, providing updates on concrete developments within SIFI such as the formalisation of the organisation structure and articles of association, appointment of an executive president and procurement of a quarter of targeted funding so far. He emphasized the organisation’s goal to use the targeted CHF 100 million of funding to unlock CHF 1 billion of capital for investments towards achieving the SDGs.

The second panel consisted of Laura Hemrika, Managing Director, Credit Suisse Foundation, Liliana De Sà Kirchknopf, Head of private sector development, SECO, Chris Clubb, Managing Director, Convergence Blended Finance, and Maya Ziswiler, CEO, UBS Optimus Foundation. With SIFI’s first call for proposals in its end stages, this panel gave insights into the process behind project selection, an outline of number and types of proposals received and the future endeavours of SIFI. The panel highlighted some noteworthy successes of their first call, for instance that 50% of proposals originated from developing countries and that the call from summer 2022, after only 3 months is prepared to name a short list of finalists, evidencing the efficiency SIFI was able to achieve. Following the panel, the newly appointed independent president of SIFI, Josien Sluijs, announced the seven finalists of SIFI’s first call and expressed her eagerness to announce the winners in the very near future.

- SSF/SECO Slidedeck

- Slidedecks coming soon

- Watch the livestream

5 October, 14:00-15:30 - Sustainable Investing 4.0: Big Data and AI for Maximal Impacts

As part of the on-going networking series "Novel Data Solutions", SSF and ZHAW collaborated on this Building Bridges workshop aiming to bridge academic research and application in the financial industry. After a welcome from Dr. Tomasz Orpiszewski, Senior Lecturer, ZHAW, and Sabine Döbeli, SSF CEO, the session consisted of four exciting presentations from Dr. Mark Thompson, Senior Researcher, ZHAW, on Spatial Science and Machine Learning for Identifying High-Impact Companies, from Tomasz Orpiszewski on how stocks react to ESG incidents, from Dr. David Jaggi, Researcher, ZHAW, on using big data for assessing green innoviation in companies and from Nicolas Jamet, Fund Manager, RAM AI, on using NLP (natural lanaguage processing) to detect greenwashing and green trends.

- Slidedecks coming soon

- Watch the livestream

5 October, 14:00-15:30 - Disclosing Climate: From International Sustainability Standards to the Swiss Climate Scores

At this session by the Asset Management Association Switzerland (AMAS) and SSF, the international sustainability standards and the way that they translate into Swiss initiatives was highlighted. The session opened with opening remarks from Adrian Schatzman, CEO of AMAS. Next Margarita Pirovska, Global Director of Policy, UN Principles for Responsible Investment, and Hortense Bioy, Global Director of Sustainable Resarch, Morningstar talked about Disclosing Climate. In the presentation by Pirovska she explores PRI's role in monitoring sustainable finance policy interventions, particularly demonstrating that policy surrounding disclosure is the most prevelant and that the Swiss Climate Scores are a great example of investor disclosure. Such dislosure is essential to form the basis of information upon which key decisions surrounding fidutiary duty and stewardship can be made. In the presentation by Bioy, she discussed the vertification challenges surrounding disclosed emission data from companies and the particular challenges surrounding estimating certain emissions for topics such as scope 3 and net zero analysis. Despite these challenges, such data is crucially important and madatory and methodological convergence of disclosures will increase the quality of emissions data over time.

In the second half of the event, Aurelia Fäh, Sustainability Expert, AMAS, offically launched the Swiss Climate Scores template. This template hopes to guarantee standardised calculation of the different indicators and uniformly displaying of results. Later, Daniela Stoffel, State Secretary for International Finance, Swiss Federal Department of Finance, and Christoph Baumann, Envoy for Sustainable Finance, Swiss Federal Department of Finance, each spoke about Switzerland's perspective and ambitions surrounding the Swiss Climate Score. Finally, two case studies, one from Philippe Le Gall, Senior Engagement Specialist, Pictet Asset Management on climate disclosures in Europe and International, which are most notably driven by net-zero commitments and regulation, and one from Ruben Feldman, Deputy Head of ESG Strategy & Business Development, Zürcher Kantonalbank Asset Management. Feldmann spoke about the potential benefits of the Swiss Climate Score, particularly surrounding uniformity and transparency, thereby assisting in compliance with current and upcoming sustainable finance regulation. The event closed with a few remarks from Sabine Döbeli, SSF CEO.

The template for the Swiss Climate Scores was revealed.

- Slidedecks coming soon

- Watch the livestream

5 October, 16:00- 17:30 - TNFD as a Solution to Address Biodiversity Risks and Dependencies

This session opened with a an introduction by Patrick Odier, President SSF, and Christoph Baumann, Head of the Taskforce on Sustainable Finance, SIF, followed by a presentation on the importance of integrating Nature considerations in Business by Nadine McCormick, Manager, Nature Actuon, World Business Council for Sustainable Development. Next, Judson Berkey, MD, group Head Engagement and Regulatory Strategy, UBS/ Member Taskforce, TNFD gave an overview of the TNFD framework and its pilot phase. On behalf of SSF and the UN Global Compact Network Switzerland (UNGC), Veronica Baker, Project Manager, SSF and Fabienne Sigg, UN Global Compact Switzerland announced the launch of the Swiss Consultation Group to the TNFD. Finally, a panel discussion moderated by Sabine Döbeli, SSF CEO, looked at the challenges and opportunities of the TNFD with Judson Berkey, Nadine McCormick and Alison Bewick, Head of Group Risk Management, Nestlé SA and TNFD Taskforce Member.

SSF/ZHAW Novel Data Solutions: Innovation in Sustainable Finance and Commodities

This event in Lugano was part of an on-going series with ZHAW, supported by Innosuisse on novel data solutions. Prof. Dr. Eric Nowak, Università della Svizzera Italiana, opened the day with a keynote on voluntary carbon markets, based on the white paper he published in collaboration with SIX. Although compliance carbon markets such as cap-and-trade systems function well, there is room for improvement when it come to organized marketplaces for voluntary carbon offsets. Most transactions are over-the-counter (OTC) and these inherently suffer from lack of price transparency, due to fragmentation and lack of standardization, and lack of liquidity and funding opportunities. Novak also explored the trend to tokenize voluntary carbon offsets and briefly presented several examples and the challenges they contain.

The next four presentations were introduced by Alberto Stival, Representative Ticino and Director Education Development, SSF, all focused on sustainable commodity trading. First Federico Piccaluga, Group General Counsel, Duferco and Oliver Ciancio, Senior Originator, DXT Commodities, jointly presented on sustainability in energy commodity trading. This illuminated the DXT Commodities business model and highlighted opportunities and challenges surrounding renewable energy business. Next, Deia Markova, Head of Trade Commodity Finance and Sustainability Ambassador, SocGen and Concord, presented a case study on how Societe Generale uncovered its financed carbon emissions and how this information is aiding the pursuit of reductions towards net-zero. Samuel Brown, Head of Climate Risk and Insurance, Celsius Pro explained how climate risk modelling can expose risks for changing product offering and accurate climate reporting. Luca Colzani, CEO, Xegate, presented their natural cement solution and its potential uses for mitigating climate degradation, particularly in deserts.

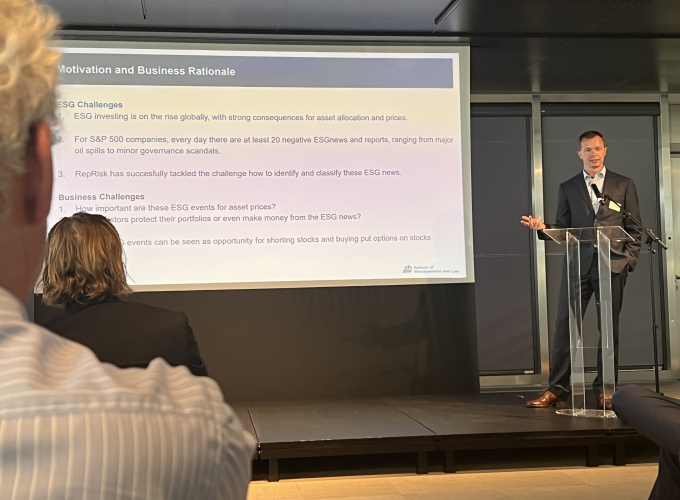

After a lunch, four further presentations focused on sustainable investing were introduced by Tomasz Orpiszewski, Senior Lecturer Institute of Wealth & Asset Management, ZHAW. The first presentation from this section come from Liz Teige, Vice President, Head of Innovation Hub, RepRisk on the topic of ESG Incidents for Companies and Mines. Next, Tomasz Orpiszewski presented a research topic of his at ZHAW concerning how stocks react to ESG incidents and the time lag between reported incidents being in the media and their effect on stock prices. Mark Thompson, Senior Researcher Institute of Wealth & Asset Management, ZHAW, introduced the brand-new Tech4SDG, a state sponsored R&D project that hopes to chart business portfolios against the sustainable development goals (SDGs). The final presentation in this section was by David Jaggi, Institute of Wealth & Asset Management, ZHAW, which focused on green innovation.

In the final part of the day a panel discussion moderated by Sabine Döbeli, SSF CEO, pondered the question "Is Technology the solution for effective sustainable investment and commodities?" The panel was made up of: Matteo Somaini, Lugano Commodity Trading Association President, DITH, Deia Markova, Head of Trade Commodity Finance and Sustainability Ambassador, SocGen and Concorde, Liz Teige, Vice President, Head of Innovation Hub, RepRisk and Prof. Dr. Eric Nowak, Università della Svizzera Italiana.

SSF Annual Conference 2022: Adressing Global Challenges

This year the SSF Annual Conference was held in person at the Kursaal in Bern. Around 250 members, networks partners and other finance experts attended the event. The day started with a welcome note by Patrick Odier, the SSF President, followed by a keynote from the CEO of Nestlé, Mark Schneider, who spoke about how to advance the sustainability agenda in food systems. He demonstrated key successes and transparent goals for an effective transition to a circular economy including regenerative agriculture, deliberate design of packaging and the support of changes in consumer behaviour. He further stressed the importance for a company to disclose carbon emissions and to demonstrate a clear reduction pathway for its business.

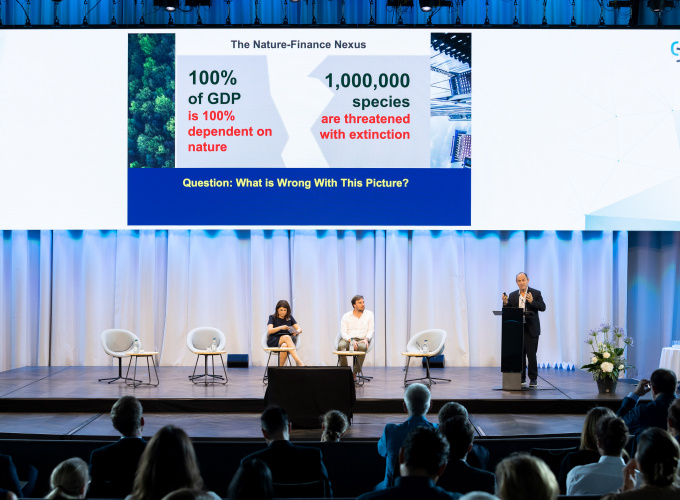

In the next session, three presentations on the topic of biodiversity and finance were delivered by three different experts in the field. Thomas Elliott, Managing Director at Crowther Lab at the ETH Zurich presented how humans impact biodiversity cycles. He presented the crucial shift needed to allow effective circular feedback loops to restore nature. Dr. Simon Zadek, Chair of Finance for Biodiversity, highlighted the evolution of financial markets and the integration of climate and nature into financial considerations. His key message was that nature and climate concerns are often treated as separate issues by industry and the financial sector, which they are not. Tony Goldner, Executive Director at TNFD, gave an overview of the TNFD framework and the value of nature as a provider of ecosystem services.

After the break, Prof. Dr. Marlene Amstad, FINMA President, gave a presentation on the Swiss regulatory context and presented the work the FINMA has implemented so far, including a heat map of identified climate risks for Swiss banks, the development of a new supervisory concept including monitoring and transparency both at an institutional and supervisory level and the publication of FINMA guidance. Finally, she highlighted that the current supervisory law has no mandatory definition of "green" or "sustainable". Taken together, this section gave a concise picture of the Swiss financial market's approach to climate risk.

In the final section, a panel led by Hannah Wise discussed the role and extent of transparency in sustainability reporting and ESG data within an academic and a corporate context. Monika Rühl, Director at Economiesuisse, Prof. Dr. Markus Leippold at the University of Zurich, Claudia Bolli, Director Head of Responsible Investing at Swiss Re Group Asset Management and Manjit Jus, Managing Director at S&P Global represented different types of data users, each with their own perspective on the biggest challenge. The discussion revealed that there is still work to be done to make sure no players are left behind and that data is of sufficient quality.

Sabine Döbeli, SSF CEO, closed the afternoon, thanking all the participants and speakers for their attendance and demonstrated SSF's willingness to continue engaging with climate and finance and helping our members to strive towards better practice, action and transparency.

Swiss Sustainable Investment Market Study 2022

On 9 June 2022, Swiss Sustainable Finance (SSF) published the Swiss Sustainable Investment Market Study 2022 at a launch event in Zurich.

The event started with an Introduction by Patrick Odier, the SSF President, and Sabine Döbeli, SSF CEO. The main section of the event was a presentation of the report, a GLIS keynote and then a panel with experts. Prof. Timo Busch, Senior Fellow at the CSP UZH and Professor at the University of Hamburg, gave an academic overview of the results and key findings on the growth of various investment approaches and key themes. Then, Hendrik Kimmerle, Senior Project Manager at SSF, presented the other key findings from the study including sustainability goals within SI approaches, net zero commitments, funds and outlook. Katja Brunner, Director Legal & Regulatory at SSF, highlighted key regulatory developments in the Swiss market in the past year including from the federal council, FINMA, the EU regulatory developments and self-regulation.

Tim Radjy, Chair of Gender Lens Initiative Switzerland (GLIS) and Managing Partner at Alphamundi Group, who co-wrote an article within the market study, presented some gender lens investing insights from the GLIS, with a particular focus on Switzerland's position. This was followed by a panel on the changing face of Swiss Sustainable investments with Gianna Müller, Responsible Investment Specialist at Helvetia, Rachel Whittaker, Head SI Research at Robeco, Patrick Schmucki, Corporate Responsibility Officer at KPMG and Regula Hess, Senior Advisor Sustainable Finance at WWF Switzerland.

Sustainable Lending Report Launch Event

At the first physical event of 2022, the new Sustainability in Lending Report was launched. The event started with a presenation from one of the report authors, Beat Affolter, Head Center Performance and Sustainable Financing at ZHAW and a keynote from Romina Schwarz, Head of Corporate Sustainability at Zürcher Kantonalbank (ZKB). Then a panel, moderated by SSF CEO, Sabine Döbeli and featuring Romina Schwarz, Andreas Holzer, Sustainable Finance Manager BLKB, Andreas Schweizer, projektleiter für Corporate Banking & Sustainable Financing ZHAW and Stephan Pomberger, Leiter Cosmofunding at Vontobel, discussed the opportunities and challenges in Sustainable Finance. The event took place in Germand and ended with an Apéro.

SSF Workshop for Institutional Asset Owners - Climate Commitments and their Practical Implications

After an Introduction by Ulla Enne, Workgroup Leader of SSF Institutional Asset Owner Workgroup and Sabine Döbeli, CEO SSF and overview of net-zero pledges by Veronica Baker, SSF Trainee. Then three presentations demonstrated case studies from Beatrice Stadler, Senior Investment Manager at Sammelstiftung Vita, Beatrix Wullschleger, Head ESG at Pensionskasse Basel Stadt and Marco Hofer, Responsible Investment Lead at AXA Switzerland. The slides and recording are available in the member's section.