Past SSF Events 2018

Measuring the impact of investment portfolios

zurich, 10 December

On 10 December, 50 practitioners joined SSF for a member workshop on the topic of “measuring the impact of investment portfolios”.

After a short introduction by Sabine Döbeli (CEO, SSF) outlining the various existing initiatives, the audience heard from experts Dr. Julian Kölbel (Center for Sustainable Finance and Private Wealth, University of Zurich) and Clara Barby (Chief Executive, Impact Management Project and Partner, Bridges Fund Management) about the impact of different sustainable investment approaches and innovative ways to report about impact.

Dr. Julian Kölbel outlined the key findings of his latest working paper entitled “Beyond Returns: Investigating the Social and Environmental Impact of Sustainable Investing”. He defined a framework for impact, stressing that investors can only have an impact if investment activities have an effect on company activity, whose operations, products or services in turn have a positive effect on society and/or the environment. Available academic research provides evidence that shareholder engagement does have a quantifiable and causal effect. For other investor actions however, such as capital allocation decisions and sustainability rankings, no academic research aiming to quantify effects on corporates is yet available.

Building on these themes, Clara Barby introduced the extensive work that the Impact Management Project (IMP) has been facilitating. The IMP has consulted with over 2000 practitioners to build a framework that can measure the impact of enterprises on people and the planet, with a thorough breakdown of impact along five dimensions (i.e. what, who, how much, contribution and risk). Clara acknowledged the challenges of the industry (i.e. data availability), but gave a hopeful message pointing out that the IMP impact categories are not meant to replace existing impact reporting frameworks, but rather serve as a checklist allowing investors to actively manage the positive and negative impacts of the underlying enterprises/assets.

Following the input presentations, participants were asked to share their practical experience. Many participants explained their own reporting frameworks and challenges they faced implementing such frameworks. The conversations provided a lot of food for thought for the SSF members, as well as, the presenters, who appreciated the detailed and constructive feedback, which will hopefully be used to drive further developments in the field.

Download working paper of Dr. Julian Kölbel

Download IMP presentation of Clara Barby

Climate-KIC and SSF Workshop: Metrics for a sustainable capital shift

zurich, 20 november

Climate-KIC and SSF co-organised a workshop on “metrics for a sustainable capital shift” bringing together a group of 30 people, consisting of providers of innovative tools and practitioners from the financial sector. The one-day workshop aimed to give an overview of existing metrics and tools and engage with participants to determine the practical use of such tools and identify gaps. (download full programme)

The first half of the day was dedicated to presenting and discussing different tools and metrics and also included a short input on European regulatory initiatives. Throughout these sessions, participants discussed the details of the metrics, highlighting their specific needs and what should be considered in the future when developing efficient tools. This lead to general discussions around data quality and value of data itself, with participants agreeing that we need to be satisfied with being “roughly right” rather than “being exactly wrong” while waiting for a perfect solution when it comes to the integration of sustainability information into investment and capital market processes.

After a warming lunch, an input on different forms of scenario analysis was given before the participants split up into groups and engaged in pragmatic and open discussions on what works so far, and what is urgently needed for achieving the sustainable capital shift. The day ended with the groups exchanging their ideas and a small farewell apero. The event received positive feedback from all participants. Bringing together developers of tools with players who apply the tools is a necessary step to further develop and adapt the tools to make them fit for purpose.

Download Climate-KIC presentation

Download Climetrics presentation

Download Influence Map presentation

Download South Pole presentation

Download Frankfurt School presentation

Private Wealth Management et Durabilité. Nouvelles directives MIFID: Quelles opportunités pour la Suisse?

Geneva, 31 october

On 31 October, SSF attracted 90 professionals to Théâtre les Salons in Geneva for an event on regulatory changes in the field of sustainable investments and their influence on private wealth management.

Sabine Döbeli (CEO, SSF) welcomed all participants and gave an overview of recent developments on the international level, driven by the Financial Centres for Sustainability initiative (FC4S). Financial centres across the world are putting sustainability on their agenda and joined forces to develop cooperations with the aim of growing this market. She stressed the importance for Switzerland to build on and further leverage its strengths in sustainable finance to maintain its competitiveness.

Martin Liebi (Deputy CEO, Head of Private Banking, Edmond de Rothschild (Suisse)) gave a welcome note explaining how sustainability fits perfectly with long-term client advisory. Yet, rolling out a broad sustainability strategy in private banking required EdR to support their investment professionals with in-depth training. The cooperation with SSF resulted in the education tools now available to all SSF members.

Providing an overview of SSF’s newly launched education tools, Jean Laville (Deputy CEO SSF), presented the motivations behind the project and summarized the content of the education material.

Giving insights into the implications of the revised MIFID regulation, Antoine Amiguet (Attorney, OBERSON ABELS), highlighted four main objectives of this pillar of the EU commission’s action plan for financing sustainable growth:

- Investment firms will have to carry out a mandatory assessment of their clients' ESG preferences in the form of a questionnaire

- Investment firms will have to take these ESG preferences into account when selecting financial products for their clients

- Ex ante information: information on ESG factors in financial products should be provided prior to the provision of investment advisory and portfolio management services

- Ex-post information: investment firms will have to prepare a report for clients explaining how the recommendation they receive meet their investment objectives, risk profile, loss capacity and ESG preferences

Following this input, Jean Laville moderated a panel of experts addressing the topic of how sustainable finance is an opportunity for the Swiss private banking industry. Jérôme Eschbach (Head of Impact Solutions, BNP Paribas (Suisse)), Claudia Giger (Branch Manager Zurich Office, Private Banking, Edmond de Rothschild (Suisse)), Alexandre Ris (Head of Product Management, Pictet Wealth Management)and Antoine Amiguet agreed that sustainable investing is receiving unprecedented attention from the media, among politicians and, of course, among institutional and private investors. They considered the SSF e-learning tool a useful instrument in making client advisors more comfortable in discussing sustainability topics with their clients, especially with young clients, who are seen as important drivers in this field. They agreed that a broad integration of ESG factors would soon be the standard, while stricter sustainability products would always be necessary to cater to a group of clients with strong ethical values.

Download OBERSON ABELS presentation

Uguaglianza di Genere: Un’opportunità per l’economia e per il mondo finanziario

vezia, 10 october

On 10 October, SSF organized an event on gender equality for its Ticino audience at Villa Negroni, Vezia. After a welcome note by Sabine Döbeli, CEO SSF, Professor Paola Profeta, Università Bocconi, gave an overview of current data on gender disparity in the workforce and in business in general. Research demonstrates that board diversity has a positive effect on share prices and reduces the risk in stock markets. She was followed by Mara Harvey, UBS, who highlighted opportunities for the financial sector by pointing out how finance needs to increase its attention to women along the entire value chain, given that an increasing amount of global wealth is under the control of women.

Subsequently, the two speakers were joined by Marialuisa Parodi, Soave Asset Management, and Jo Andrews, Equileap, in a roundtable discussion moderated by Vera Pellandini, RSI. The rich discussion revolved not just around the implications of the gender gap – both in terms of representation and payment – but around the importance of diversity in a company as a whole. Anecdotal, but also eye-opening quotes such as the fact that there are more men named Steve on the boards of large British companies than women showed that there is still a long path ahead to gender equality.

Download Università Bocconi presentation

Download press article from Ticino Management Donna

SSF and twentyfifty workshop: Understanding human rights due diligence requirements for the financial sector

ZURICH, 25 september

As part of series of workshops on the topic of business and human rights for Swiss companies, commissioned by the Swiss government, SSF co-organised an event with twentyfifty. Around 40 participants were present at the interactive workshop hosted by UBS in Zurich. Sabine Döbeli, SSF CEO, welcomed the participants and highlighted results from the recent Sustainable Investment Market Study, which showed that considerable awareness and specific investment strategies for addressing human rights are already present in the Swiss financial industry.

Sarah Dekkiche, Director of Consulting, and Annik Bindler, Consultant at twentyfifty then engaged participants in practical exercises. twentyfifty provided participants with an overview on national and international human rights frameworks such as the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises. Amina Joubli, SECO and Patrick Matthey, FDFA, presented government activities and the Swiss national action plan for the implementation of the United Nations Guiding Principles.

The second part of the workshop focused more specifically on the practical implementation of human rights due diligence into business operations. Participants were invited, throughout practical exercises, to reflect on the concrete implications for their own business: What are the main areas for potential human rights impacts of my company and its business relationships (including direct and indirect impacts)? What management processes are already in place in my company to address potential impacts, and what are potential gaps? Based on the gaps, could I further priorities through identifying the most salient risks?

This resulted in active and critical discussions, covering not only the prevention and mitigation of adverse human rights impacts, but also the positive human rights contribution companies make by creating access to socio-economic opportunities.

Following the workshop, participants enjoyed a networking lunch and had the chance to further exchange insights and ideas on business and human rights.

Download twentyfifty presentation

Further resources for discussion:

Swiss National Action Plan - Business and Human Rights

OECD: Responsible business conduct for institutional investors

Philipp Aerni (2015). Entrepreneurial rights as human rights

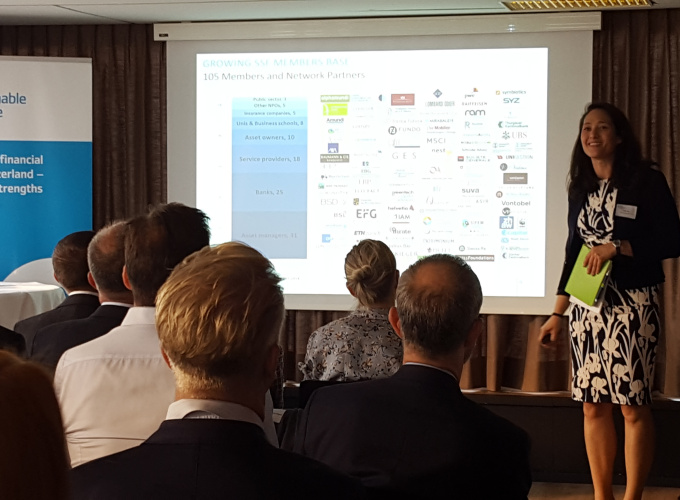

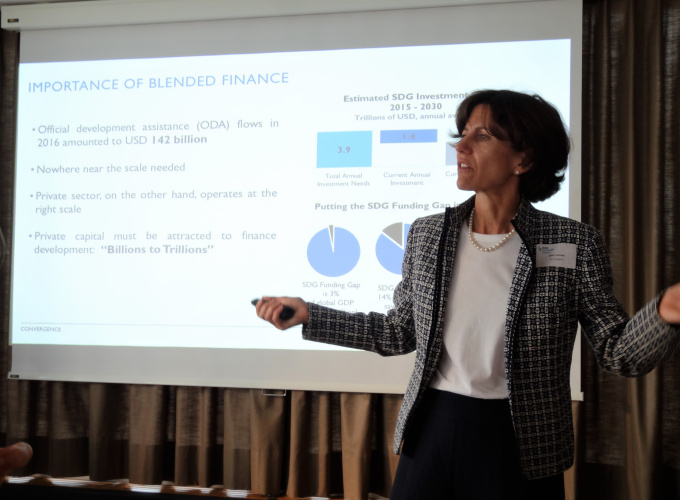

SSF and Convergence event: Blended Finance Information Session and Networking Breakfast

Zurich, 28 august

Over 50 participants interested to learn more about blended finance gathered together on 28 August in Zurich for this co-hosted event of SSF and Convergence, moderated by Aakif Merchant (Blended Finance Specialist, Convergence). Opening the event with a Swiss outlook on blended finance was Ivo Germann (Head of Operations of Economic Development Cooperation Directorate, SECO). Ivo explained how SECO has dealt with the topic, indicating past successes, as well as failures. In addition, he outlined the project SECO 17, which closed in January 2018, meant to promote blended finance solutions within the Swiss market through providing TA funding to innovative investment solutions.

Kelly Hess (Senior Project Manager, SSF) introduced SSF to the audience and in particular the SSF Workgroup “Investments for Development”, which identified partnerships and blended finance as a key area of focus for Swiss players. The workgroup initiated the idea for SSF’s first full-day conference on “Inspiring investment partnerships to achieve global goals”. Following Kelly, Joan Larrea (CEO, Convergence), explained how Convergence became a global network for blended finance creating deal flow to increase private sector investment in developing countries. Joan went on to discuss the role of different market players (i.e. development agencies, multilateral development banks and national DFIs, private investors, and Philanthropic foundations) in producing successful blended finance solutions.

The event closed with two exciting presentations of cases of blended-finance products from Swiss actors. Tanja Havemann (Founder, Clarmondial) presented an open-ended investment fund for private credit in agriculture, which was granted design funding from Convergence. Maria Teresa Zappia (CIO, BlueOrchard) presented their innovative solution for a Sub-national climate fund focusing on Africa, which was awarded funding for technical assistance through the SECO-17 project.

During the subsequent networking breakfast, participants had a chance to further discuss their ideas around blended finance and get to know key players in the field.

Download the Convergence presentation

SSF member events: Launch of SSF education tools for financial professionals - "Sustainable investments in a changing world"

GENEVA, lugano, zurich

At the SSF education tools launch event series in summer 2018, SSF presented the newly developed education tools to its members at sessions in Geneva, Lugano and Zurich. The SSF education tools consist of a slide deck and an e-learning module, developed by SSF in collaboration with Edmond de Rothschild.

The first event, organised and hosted along with Edmond de Rothschild took place in Geneva. Kate Cacciatore, Global Head of Sustainability, Edmond de Rothschild Group (EdR), and leader of the SSF education workgroup explained how EdR identified the need for a training tool that provides an in-depth background on sustainability and its role for investors. Teaming up with SSF to develop it, the collaboration offered opportunities to both sides. During all three sessions, Jean Laville, Deputy CEO SSF, presented the slide-deck on sustainable investments that can be used for internal training by sustainability specialists. He also provided a step-by-step introduction to the four modules of the e-learning, which are tailored specifically to the needs of finance professionals and include case studies as well as sustainability profiling of clients.

The interactive and practical value of the tool was highly appreciated by all audiences, which lead to valuable discussions on the best ways to disseminate the tool among members and network partners. Sabine Döbeli, CEO SSF, expressed the hope that the tool will be useful for many SSF members and thanked Edmond de Rothschild for their valued support for the e-learning tool. SSF would also like to thank Vontobel for hosting the event in Zurich.

SSF members can access the education tools in the members’ section of the website.

SSF Annual Conference 2018: Game-changers in finance – leveraging Swiss expertise

BERN, 19 JUNE 2018

For the SSF annual conference 2018, 160 finance professionals came together to follow presentations and panel discussions of national and international finance experts. Please view the full event program for detailed information and have a look at the video footage of the event. Also visit the event website for speaker profiles.

SSF President Jean-Daniel Gerber welcomed the participants and then handed over to Sabine Döbeli (CEO, SSF) presenting the SSF highlights of the year. One of the main topics was the trend in Switzerland for sustainable asset allocation by institutional investors. The new SSF Sustainable Investment Market Study 2018 shows a significant increase in corresponding investments. (View video of Jean-Daniel Gerber and the video of Sabine Döbeli as well as her presentation)

The first keynote speaker Simon Zadek from the UNDP (also serving as secretary of the G20 Green Finance Study Group and former co-chair of UNEP Inquiry) presented initiatives for international cooperation in the field of sustainable finance and emphasized the connection to digitalisation as a "game changer" and driver for sustainable solutions. He stressed the discussion at international level had clearly gained momentum. While efforts are following the right direction, current measures are not sufficient, both globally and nationally to achieve sustainability goals. Thus, while doing more of the same will help to go in the direction of the desired results, real change only will only come about by leveraging the whole system. (View video of Simon Zadek and download his presentation)

Thereafter, a panel on the impact of institutional asset owners’ demand on sustainable finance brought together Olivier Ginguené (Chief Investment Officer, Pictet Asset Management), Frank Juliano (Head of Asset Management, compenswiss) and Ambassador René Weber (Head Policy Coordination Division, State Secretariat for International Finance (SIF)). The interactive discussion, moderated by Angela de Wolff (Partner, Conser Invest), touched upon the issue of integrating ESG into the concept of fiduciary duty, as well as institutional asset owners’ take on climate risk. Views on fiduciary duty were diverging though all panelists agreed material ESG risks need to be taken into account as to not breach it. (View video on the asset owner panel)

In an expert input, Prof. Reto Knutti, climate physicist at ETH, called for scientific research results to be taken seriously by the financial industry. These clearly indicate climate change is happening in an accelerated manner and is man-made. He considered a common taxonomy on sustainability criteria (ESG) to be central, although such a taxonomy must leave room for innovation as the latter is key to combat global warming. However, according to his opinion new technologies to withdraw CO2 from the atmosphere, such as carbon capture and storage, will not be sufficient to halt global warming given their current limited scale. Instead, we need to find ways to massively reduce emissions of greenhouse gases. (View Prof. Reto Knutti's video and download his presentation)

In the second panel, Remy Briand (Managing Director, Head of ESG, MSCI), Reto Knutti (Professor, ETH), Peter Munro (Director, Market Practice and Regulatory Policy, International Capital Markets Association (ICMA)) and Rachel Whittaker (Sustainable Investing Strategist, UBS), discussed the topic of integrating climate research results into investment decisions. In her moderator role, Sabine Döbeli (CEO, SSF) asked how the integration of climate factors could provide financial value to investors as opposed to being perceived as a risk only. The panelists agreed that most clients still had to be convinced that investing sustainably and climate friendly does not imply lower financial performance. Furthermore, the group agreed that creating a taxonomy would benefit their business, as it would make their products more understandable and transparent for clients. This is especially the case for green bonds. However, too much standardization could stifle the market and create a barrier to growth. Finally, all participants were of the opinion that climate change was but one, albeit a very important, dimension of ESG analysis, which has to happen simultaneously to be most effective. (View video of second panel on integrating climate research into investment decisions)

Finally, the main keynote speaker, International Finance Corporation (IFC) CEO Philippe Le Houérou, voiced concerns that the world was losing the fight against climate change and quoted French President Macron to illustrate his point: “There is no plan B for global climate measures, and there is no planet B either”. Based on World Bank studies, he predicted massive annual losses in consumption and growth due to global warming, especially for developing countries. The positive news, however, were that the private sector has realised climate change also offers major business opportunities. Private financing, in combination with public funding, therefore is key to bring about a turnaround. Yet, the question of how the necessary private investments can be mobilised ("crowding-in") has not yet been answered. The need and private means are there, but the bridge must be built even more effectively. In this sense, the IFC is committed to building (green) markets through changes in the frameworks of target countries. The creation of markets for green bonds is an example of this. In addition, the IFC absorbs project risks ("de-risk projects") by entering into agreements with local authorities that provide private companies with sufficient security for investments. The advisory activity of IFC is at least as important as the provision of finance. (View video of Philippe Le Houérou's speech)

Lancierung der Schweizer Marktstudie Nachhaltige Anlagen 2018

Zurich, 1 June 2018

On 1 June SSF presented its 2018 Swiss Sustainable Investment Market Study to an audience of 120 participants. The event was opened by Hubert Niggli, Head of Finance at Suva and Vice President of SSF, who stressed the importance of consistently and regularly assessing market data against the backdrop of increasing competitiveness of financial centres in the field of sustainable finance. He then gave the word to Sabine Döbeli (CEO, SSF), who, along with research partner Prof. Timo Busch, Senior Fellow at the Center for Sustainable Finance and Private Wealth (CSP), the University of Zurich, discussed the study results. One of the key messages was that the total market growth of 82% could be attributed to increased market coverage, a rise in first-time adoption of sustainable investment approaches, and growth of existing participants’ sustainable assets. Prof. Busch gave insights into key barriers for SI, including performance concerns and lack of standards. Finally, the changing regulatory framework as well as a comparison between the European initiatives and Swiss approach was also discussed.

In the panel discussion that followed, speakers Manuela Guillebeau (Investment specialist, comPlan), Hubert Niggli (SUVA), Ratana Tra (Senior Advisor, Siglo Capital Advisors) and Pius Zgraggen (CEO, OLZ AG) talked about their organisations’ specific sustainable investment approaches and their thoughts on the market study findings. OLZ CEO Pius Zgraggen provided interesting insights into how his organization integrated ESG across their entire asset base. Ratana Tra gave his perspective on the growing interest from the industry as a consultant specialized in pension funds. The panelist from comPlan and Suva, both SVVK members, discussed how they integrate sustainability into their investments, using guidelines set out by SVVK and the advantages of teaming up with other large market players for effective engagement with companies. During the discussion, moderator Sabine Döbeli asked the panel about their opinions on current trends, such as the push for regulation by the EU or the trend towards passive investing. Amongst other topics, the panel debated the issue of the impact of exclusion vs. ESG engagement, the challenge of aligning financial flows with the Paris Climate Goals, and the SDGs as a valuable global standard.

To conclude the event, SSF CEO Sabine Döbeli thanked the respondents, sponsors, SSF workgroup members, authors and research partners of the study and discussions continued afterwards during the networking lunch.

The full market study report is available as English full version as well as German and French summary versions.

Nachhaltige Anlagestrategien leicht gemacht? Neue Instrumente der PRI für institutionelle Anleger

Zurich, 17 April 2018

On 17 April, Swiss Sustainable Finance (SSF) and Principles for Responsible Investment (PRI), highlighted how sustainable investment practice evolves and which path Swiss institutional investors are taking. Sabine Döbeli (CEO, SSF) and Dustin Neuneyer (Head of Continental Europe, PRI) welcomed around 100 participants, followed by a presentation of the PRI AO Investment Strategy Guide and the Manager Selection Guide, held by PRI’s Director of Investment Practices and Reporting, Kris Douma. The latter noted in particular, that real world impacts need to be taken into account as a third dimension, when setting a risk/return profile for investment. To complement the theoretical guidelines with a practical example, Marcel Metry (Head Equity & Investment Process, BVK Personalvorsorge des Kantons Zürich) laid out how BVK implements an engagement and exclusion strategy, combining norms-based screening and product-based exclusions. Due to their broad base of beneficiaries in terms of values, a suitable norm consensus is Swiss Law as well as the ILO Conventions.

In the following panel discussion, Marcel Metry, Lukas Riesen (Partner, PPC Metrics), Reto Portmann (CEO, ZKB Pension Fund) and Marc Hänni (Head of Swiss Equities, Vontobel Asset Management) discussed questions raised both by the moderator Dustin Neuneyer and the audience. The panelists agreed that the inclusion of material ESG criteria is already becoming best practice in the financial sector, though the time horizon plays an important factor in determining materiality. Clients have expedited this change as they now approach asset managers with a basic understanding of ESG investing, unlike five years ago.

The question of passive sustainable investment was also discussed, where a majority of the panelists were of the opinion that the decision whether to invest active or passive is independent from the sustainability topic. Given that sustainability indices have a high turnover due to their changing composition, some even considered investing according to those indices to be a form of active investment. As long as an organization only chooses to do engagement however, a passive strategy, working with traditional indices, was seen as a suitable basis. Finally, the panelists mentioned that the Paris Agreement, now ratified in Switzerland, would also have an impact on the norms basis of Swiss investors, meaning climate change figures such as CO2 emissions will increasingly have to be included in the investment process.

Download PRI Asset Owner Strategy Guide

Download PRI Asset Owner Manager Selection Guide

Launch event: English edition of SSF Handbook on Sustainable Investments, co-published with CFA Institute Research Foundation

Zurich, 27 February 2018

At the Launch of the English Handbook on Sustainable Investment for Asset Owners, SSF, the CFA Institute Research Foundation and the CFA Society Switzerland hosted 140 finance professionals interested in responsible investment. The audience was welcomed by Sabine Döbeli (CEO, SSF) and Christian Dreyer (CEO, CFA Society Switzerland).

In the first part of the event, Joachim Klement (Trustee of the CFA Institute Research Foundation and Head of Investment Research, Fidante Capital) underscored the importance of the collaboration of CFA and SSF, which will help promote educational material on sustainable investment in the CFA community. Afterwards, Alexander Zanker (Senior ESG / Quant. Strategist, LGT Capital Partners) presented a concise overview on academic research on the influence of ESG factors on financial performance. The vast majority of studies showed a neutral to positive effect of good sustainability performance on financial metrics. The following presentation by Rainer Baumann (Head of Investment Management and Member of the Executive Committee, RobecoSAM) then provided the audience with a concrete example, on how a company can integrate ESG criteria into all investment decisions. For a sound integration, consistent data on material ESG metrics is key.

Download Sabine Döbeli's presentation

In the second part of the event, Sabine Döbeli moderated a panel featuring Johanna Köb (Head Responsible Investments, Zurich Insurance Company), Kaspar Hohler (Editor in Chief VPS) and Joachim Klement on how regulatory pressure changes the way institutional asset owners view sustainable investment. The experts brought forward that Swiss pension funds increasingly start to adopt sustainable investment policies, partly due to public pressure, partly in an attempt to prevent the need for regulation. The topic has not won as much traction as it could have due to the scattered pension fund landscape in Switzerland, characterised by numerous small players, who do not necessarily prioritise the issue due to resource constraints. Yet, the concept of fiduciary duty has clearly widened to include the integration of ESG criteria in investment decisions.

Amongst other barriers to responsible investment, the panellists mentioned tenacious myths on inferior performance of sustainable investment, limited education on ESG criteria as well as a cautious attitude on the topic by investment advisors. The latter do not have sufficient incentives to actively promote the uptake of sustainable investment strategies, given their clients are often bound to short-term performance targets. While public discourse predominantly revolves around the “E” of ESG integration at the moment, the panellists agreed that a sole focus on climate change was not in the interest of institutional investors. However, managing sustainability risks, with climate change being an urgent topic, was viewed as crucial for future success. Finally, the discussion showed that the SDGs offer a suitable framework to demonstrate investment impact.

To conclude the event, Sabine Döbeli and Christian Dreyer jointly unveiled the English Handbooks and handed a copy to all participants.

Download the English Handbook on Sustainable Investments

Inspiring investment partnerships to achieve global goals

Zurich, 16 January 2018

At SSF's first international conference in Zurich on 16 January, some 240 participants from 12 countries seized the opportunity to inform themselves about innovative partnerships for development investments. Please view the full event program for detailed information on the event. Also visit the event website for speaker profiles.

|

Watch recordings and download presentations from the event: |

|||

| 9:00-9:15 | |||

| 9:15-10:00 |

Karin Finkelston, Vice President, Partnerships, Communications, and Outreach, IFC, World Bank Group |

||

| 10:00-11:00 | Video of Expert panel: Challenging the public sector - What role do Development Finance Institutions play in mobilising private capital | ||

| 11:30-12:30 | Video of Expert panel: Challenging the private sector – How is private industry supplying solutions | ||

| 13:45-14:15 |

Video of OECD Presentation: Partnership models in blended finance: an expert overview |

||

| 14:15 - 16:45 | Presentations and summaries of breakout sessions | ||

| 16:45-17:15 |

Video of Closing keynote: Promising business partnerships - the foundation for sustainable growth! Ulrich Frei, Executive President, FUNDES Internacional |

||

After the welcome notes of Jean-Daniel Gerber, President, Swiss Sustainable Finance and Ambassador Raymund Furrer, Head of the Economic Cooperation and Development Division, SECO, keynote speaker Karin Finkelston, Vice President Partnerships, Communications, and Outreach at the International Finance Corporation (IFC), presented concrete examples illustrating how private investment can improve livelihood while delivering attractive returns. (View IFC video on partnerships in Burkina Faso and Karin Finkelston's full keynote).

Following the keynote were two expert panel discussions. In the first panel, Challenging the public sector - What role do Development Finance Institutions play in mobilising private capital, Claudia Arce (Director of South Asia, KfW), Orlando Ferreira (Chief Strategy Officer, IDB Invest), Ivo Germann (Head of Operations of Economic Development Cooperation Directorate, SECO) and Nick O’Donohoe (CEO, CDC Group) discussed with the moderator Maria Teresa Zappia (Chief Investment Officer, BlueOrchard) the role of development finance institutions in mobilising private capital. (View the full panel discussion)

The second panel, moderated by Sabine Döbeli (CEO, SSF), brought in the views of the private sector with Ivo Menzinger (Head of Global Partnerships, Swiss Re), Christophe Nuttall (Executive Director, R20 Regions of Climate Action), François Perrot (Head of Affordable Housing & 14Trees Ltd, LafargeHolcim) and Manuel Rybach (Global Head of Public Affairs and Policy, Credit Suisse) reviewing their efforts with respect to partnerships and investments towards development. (View the full panel discussion)

To prepare participants for the afternoon, Wiebke Bartz-Zuccala, Policy Analyst and Haje Schütte, Head Financing Sustainable Development Division from the OECD set the stage by introducing their research and perspectives on partnership models in blended finance. (Video of the full presentation)

During the afternoon breakout sessions, six examples of targeted partnerships for investments for development illustrated the opportunities resulting from such cooperations. De-risking through development banks, government technical assistance, local industry knowledge of companies, and financing of advisory programs by foundations or other partners help create investment tools contributing to achieve the SDGs while generating attractive returns. All breakout session presentations and summaries can be downloaded below.

To close the day, Ulrich Frei (Executive President, FUNDES Internacional) animated the audience with the history of how FUNDES evolved from a purely philanthropic entity to a self-sufficient, profitable and mission driven endeavor, providing solutions to micro and small enterprises in Latin America. He went on to elaborate on the extensive and structured partnership evaluations that were utilized during the company's transition phase. The key learnings he presented were perfect take-away messages for the conference delegates to end the day. (View the full keynote speech)

Download the summaries of all breakout sessions

| Breakout Session | Presentations | |

| Breakout A: Private Equity investments in context of SDG’s and impact investments | ||

| Breakout B: Using fixed income to support the growth of SMEs | Presentation Symbiotics, UBS, SECO | |

| Breakout C: Engaging listed multinationals - how to increase positive impact | Presentation de Pury Pictet Turrettini, KOIS Invest, BHP - Brugger and Partners | |

| Breakout D: Promoting access to climate insurance | Presentation BlueOrchard and CelsiusPro | |

| Breakout E: Emerging Market green bonds to finance the low carbon economy in developing countries | Presentation Amundi and IFC | |

| Breakout F: Investments into technical solutions to fight poverty | ||

Event sponsors: