| |

|

|

| |

|

|

| |

|

SSF Newsletter April 2025

|

| |

|

Preserving Value

|

| |

|

Dear Sir or Madam,

|

| |

|

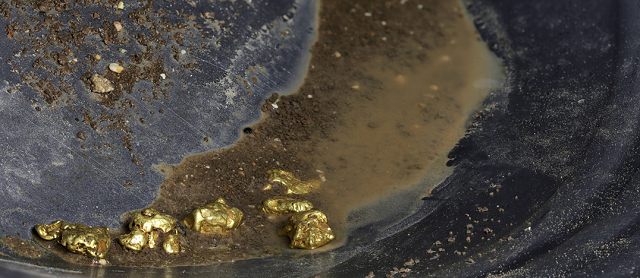

Over the past year, gold has reached unprecedented levels in both demand and price. This highly sought-after precious commodity has captured the attention of investors worldwide and has often made headlines in the news. Gold fulfils multiple roles as an investment asset, including being sought after during periods of geopolitical and economic uncertainty, much like the conditions we are experiencing today.

Thus, SSF's recent spotlight publication "Responsible Gold Investments" could not have been more timely. In this report, SSF provides a comprehensive overview of the gold value chain, the ESG challenges it faces, and proposes tools, standards and recommendations for a path to responsible gold investments. Switzerland is uniquely positioned to lead the responsible gold investment space due to its concentration of key actors across the gold value chain — refiners, banks, NGOs, and innovative startups — and we have drawn on the expertise of countless professionals dedicated to making the gold supply chain more sustainable over the years.

At SSF, we view finance as a lever for change. Through this report, we aim to inspire all actors in the gold investment value chain to leverage their influence to promote responsible gold investments. After all, responsibly sourced gold shines even brighter!

|

|

| |

|

|

Kind regards

Daniela Lavrador

SSF Director Romandie

|

| |

|

|

|

| |

|

|

| |

| |

| |

|

SSF activities at a glance

|

| |

|

| |

|

Responsible Gold Investments

|

| |

|

This Spotlight delves into the gold value chain, key ESG challenges and responsible investment strategies. It outlines the sources of gold, addressing ESG risks such as corruption, human rights violations and environmental harm. The report emphasises investor solutions for enhancing transparency, traceability and sustainable practices. Read the spotlight here.

|

| |

|

|

|

| |

| |

|

New platform for the SSF Academy!

|

| |

|

With sustainable finance having grown in importance over the years, education on sustainable finance is becoming key for all financial market players. We are excited to launch our new platform for the SSF Academy! Our Platform combines eLearnings on sustainable finance developed by ourselves with an overview of existing courses available in Switzerland on sustainable finance, to help you find the education path that best fit your learning goals and needs. Explore the platform here.

|

| |

|

|

|

| |

| |

|

SSF Annual Report 2024 now available!

|

| |

|

Read our Annual Report to learn about our key activities in 2024, which we have reached thanks to the support of and collaboration with our dedicated member base! Some highlights from last year include the SSF 10 Year Anniversary, the first edition of our Swiss Sustainable Lending Market Study and the establishment of the Swiss Platform for Impact Investing (SPII). Read the Annual Report here.

|

| |

|

|

|

| |

| |

|

SSF Lending Market Study Questionnaire

|

| |

|

SSF is collecting data for the Swiss Sustainable Lending Market Study 2025. By providing data, you help SSF obtain an encompassing overview of the market development in this important field. If you have not received an invitation but wish to take part in this survey please visit our website or contact us.

|

| |

|

|

|

| |

| |

|

Workshop - Impact Investing

|

| |

|

SSF was thrilled to partner with the Principles for Responsible Investment (PRI) to host an inspiring and action-driven workshop focused on empowering Asset Owners in the world of Impact Investing. Together, we discussed actionable strategies for Asset Owners to navigate impact investing, focusing on how to identify and scale investments that generate both financial and social/environmental returns. Read an event summary on our webpage.

|

| |

|

|

|

| |

| |

|

Artificial Intelligence working group held its first session

|

| |

|

SSF hosted its first workshop on Artificial Intelligence and Sustainable Finance, launching a new initiative to explore the intersection of technology and sustainability. In collaboration with ZHAW School of Management and Law and BearingPoint, the session brought together professionals from the banking and asset management sectors to discuss how AI can enhance ESG analysis and responsible investment strategies. Read more on our website.

|

| |

|

|

|

| |

| |

|

Impact Investing Webinar: Market Insights

|

| |

|

In partnership with the Global Impact Investing Network (GIIN), we launched the first session of a new webinar series for the Swiss Platform for Impact Investing (SPII), focused on sharing insights and practical examples from the Swiss and global impact investing markets. This series aims to provide valuable market insights and practical examples tailored to the Swiss impact investing landscape. Find out more information here.

|

| |

|

|

|

| |

|

|

| |

| |

|

Regulatory and market news

|

| |

|

| |

|

Swiss News

International News

- US pension funds to target directors over Artificial Intelligence oversight failings. US pension funds are sharpening their focus on director oversight of company AI usage, with three funds across the country adding language to their voting policies on holding them accountable for poor AI oversight. This is likely to be the first step towards increased integration of AI governance as a responsible investing monitoring criteria.

Market News

-

The University of Geneva, with support from the Swiss National Science Foundation, is conducting a research project on the evolving landscape of impact investing in Switzerland. To inform this work, they invite participants to complete a 15-minute survey exploring perceptions, practices, and motivations in the country’s impact investing ecosystem.

-

The IFRS Foundation and the Taskforce on Nature-related Financial Disclosures (TNFD) have signed a Memorandum of Understanding to strengthen collaboration and integrate TNFD's nature-related disclosure recommendations into the work of the International Sustainability Standards Board (ISSB). This partnership will support the ISSB's ongoing Biodiversity, Ecosystems and Ecosystem Services (BEES) research and help enhance nature-related aspects of its sustainability standards, including the SASB standards.

|

|

| |

|

| |

| |

|

New SSF members and network partners

|

| |

|

| |

|

We are happy to welcome the following organisations as new SSF partners:

The full list of our members and network partners, now standing at 262 can be found here.

|

|

| |

|

|

|

| |

- 6 May 2025: AMAS/SSF Event The Swiss Stewardship Code from Experience to Action: Practical Takeaways and Strategies, Register here.

- 7 May 2025: SFG/ BB/ SIFI/ Housewarming - Maison de la finance durable. Find out more information here.

- 14 May 2025: GreenBuzz/ CelciusPro/ Pelt8 (in partnership with SSF): Swiss Climate Reporting Forum 2025. Find more information here.

- 15 May 2025: Launch Webinar: Responsible Gold Investments. Register here.

- Save the date: 12 June 2025: Webinar: "Why sustainable investments still makes economic sense?", with MSCI and LGT

- 17 June 2025: SSF Annual Conference

Further events are listed on the SSF website.

|

|

| |

|

| |

| |

|

SSF and sustainable finance in the media

|

| |

|

|

|

|

|

|

| |

|

Banks’ climate commitments: a silver lining for climate action or just hotair? First evidence from the Swiss mortgage business

|

| |

|

This research study delves into the challenges that Swiss banks have the capacity to achieve net-zero emissions in their mortgage portfolios by 2050. The study highlights a global concern that, without regulatory mandates, voluntary climate efforts by banks are likely insufficient to meet targets, risking setbacks in the fight against climate change.

|

|

More >

|

| |

|

| |

|

Private Asset Impact Fund 2024

|

| |

|

The 5th edition of the Private Asset Impact Fund (PAIF) Report from Tameo analyses the private asset impact investing market, covering 798 funds and 468 managers. It highlights the dominance of private equity, Luxembourg’s growing role, and strong investment in sub-Saharan Africa. Despite a tough fundraising climate, the sector showed resilience with new funds, innovative strategies, and wider adoption of impact practices, pointing to steady momentum in sustainable finance.

|

|

More >

|

| |

|

|

|

| |

|

CSP Investors Guide to Systemic Investing

|

| |

|

The Center for Sustainable Finance and Private Wealth's Investor Guide to Systemic Investing explores how systems thinking can reshape investment strategies to tackle complex global challenges. It promotes a shift from isolated solutions to collaborative, long-term value creation across portfolios. Backed by practical tools and a growing community, it equips investors to align their capital with deeper, systemic impact.

|

|

More >

|

| |

|

| |

|

Impact as a source of alpha? The elephant in the room

|

| |

|

A recent study by Schroders and Oxford Saïd Business School's Rethinking Performance Initiative shows that impact investing can outperform, countering the idea that doing good limits returns. Using data from firms, it links impact materiality to stronger performance, with higher margins, job growth, and reinvestment proving purpose and profit can go hand in hand.

|

|

More >

|

| |

|

|

|

| |

|

How are Financial Institutions in Europe Addressing Human Rights in Their Core Business Activities?

|

| |

|

A study by the Geneva Center for Business and Human Rights surveyed 75 professionals and held 10 interviews to assess how European financial institutions address human rights. Covering banks, insurers, and asset managers across six countries, it focused on internal practices and client relations. Firms managing €14 trillion in assets took part.

|

|

More >

|

| |

|

|

| |

|

Would you like to find out more about recent developments in sustainable finance and members-only SSF activities? SSF members receive access to additional resources. Join our growing community to profit from it.

|

|

| |

|

| |

|

Kind Regards

The SSF Team

|

| |

|

|

|

| |

| |

|

Already a member or partner? Make sure you are featured on our website. Get in touch with us to upload your member or network partner profile now.

Interested in joining our network of members and partners? > Learn more

|

|

| |

|

| |

|

SWISS SUSTAINABLE FINANCE

|

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |