Swiss Sustainable Investment Market Study 2020

For the third consecutive year, SSF publishes its comprehensive market study, which sheds light on sustainable investment (SI) developments in Switzerland.

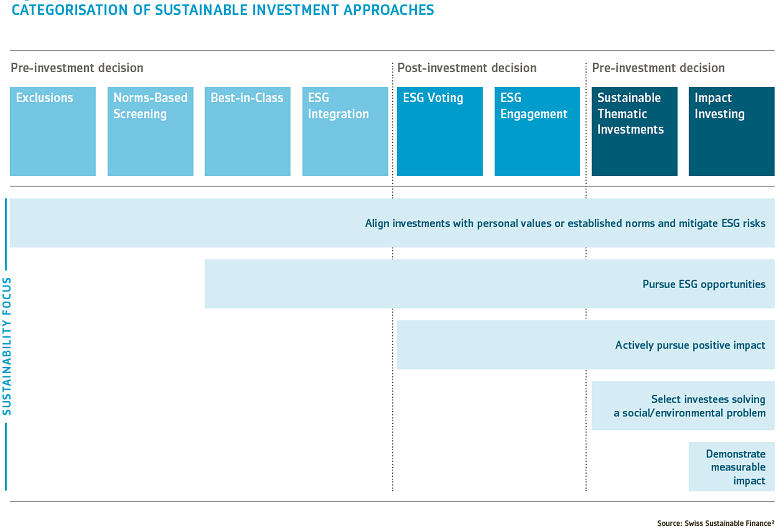

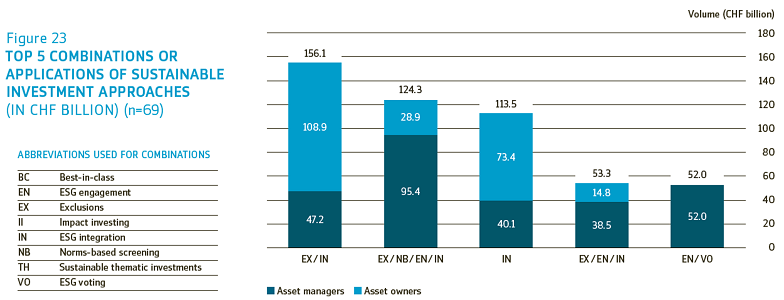

With a total of 76 respondents, including many of the large asset managers and asset owners, the study gives a fair overview of the Swiss SI market. As a new feature, this year’s survey looks at common combinations of SI approaches prevalent in the market. This is particularly valuable, as it is a useful contribution to the growing political debate about the quality and impact of investments.

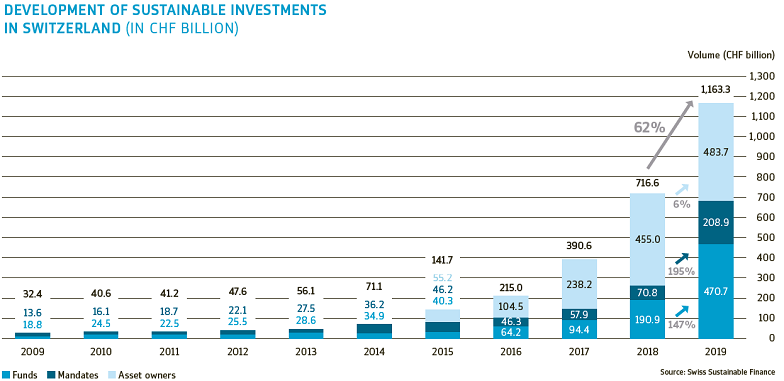

In 2019, the total volume of sustainable investments reached CHF 1,163.3 billion. This includes all reported sustainable investment funds, sustainable mandates and sustainable assets of asset owners. The market growth of 62% can be ascribed to three main effects: a wider adoption of SI approaches, the positive market performance in 2019 and changes in methodology. With very high growth rates observed for more “outcome-oriented” SI approaches (i.e. ESG engagement and voting, as well as impact investing), the market seems to be putting a stronger focus on achieving more real-world outcomes with their investments.

The market study also includes a comprehensive chapter on regulatory issues in Switzerland, the EU and globally.

Download the report in English

Download key figures from the report

Selected Figures From the report