Past SSF Events 2023

SSF workshop for institutional asset owners: Applying the ASIP ESG Reporting Standard

This workshop brought around 30 Swiss asset owners together to share experiences around implementing the recommendations of the ASIP ESG Reporting Standard published in December 2022. During the workshop, Jürg Tobler, Deputy CEO and CIO of the City of Zurich Pension Fund, who co-lead the work on the ESG Reporting Standard for ASIP, outlined the main elements of the guidelines and considerations behind them. He also gave a short overview of the City of Zurich Pension Fund’s report, which incorporates the ASIP Standards where possible. Ulla Enne, Head Responsible Investing & Operations, Nest Collective Foundation, gave additional practical insights into their experience implementing the ASIP Standards. Slides are available for SSF members.

Within three breakout groups, the participants then discussed their views and experiences with peers facing similar issues and identified the biggest challenges and areas where further steps are needed.

SSF Sustainable Real Estate Investments Webinar

In this webinar from SSF, Sabine Döbeli, CEO SSF, opened the webinar by highlighting the role of reducing emissions for the building sector. Then, Dr. Hendrik Kimmerle, Senior Projcect Manager SSF and Laura Archer-Svoboda, Research Associate ZHAW, presented the SSF Spotlight report on Sustainable Real Estate Investments. After the report presentation, Alexandros Gratsias, CFA, Head Sustainable Real Estate Investments at Bank J. Safra Sarasin AG shared his perspective on portfolio implementation. Finally, Prof. Eric Jondeau, Professor of Finance at the University of Lausanne, provided an academic perspective on how to improve sustainability transparency of real estate portfolios.

SSF/AMAS Event: Introducing the "Swiss Stewardship Code"

At this event in Zurich, Swiss Sustainable Finance (SSF) and the Asset Management Association Switzerland (AMAS) presented the recently published the Swiss Stewardship Code, which provides asset managers, asset owners and financial service providers with guidance to encourage the active exercising of shareholder rights by investors in Switzerland. The event was opened by Adrian Schatzmann, CEO AMAS, followed by a presentation of the code by Katja Brunner, Director Legal & Regulatory, SSF and Aurélia Fäh, Senior Sustainability Expert, AMAS. The last section of the event was a roundtable moderated by Sabine Döbeli, CEO SSF with the following experts from the working group that helped develop the code; Dominque Habegger from de Pictet Turrettini, Christoph Wenk Bernasconi from SWIPRA Services and Julia Wittenburg from J Safra Sarasin.

Asset Owner Workshop: Real Estate

This workshop in Lausanne focused on the challenges related to the sustainability of real estate investments in Switzerland, an important asset class for pension funds and insurance companies. Jean Laville, Deputy Director, Swiss Sustainable Finance, presented the latest SSF publication in sustainable real estate, followed by two speakers sharing Retraites Populaire's approach to sustainbility in real estate; Laure Castella, ISR Specialist and Risk Manager and Gérard Greuter, Deputy Director, Head of the Renovations and Sustainable Energy Department, Real Estate Division. The aim of the workshop was to discuss opportunities and challenges related to real estate sustainability and define potential actions to support the decarbonization of real estate stocks.

E-foresight Forum: "Sustainable Finance – are we at a tipping point for sustainable finance?"

At this trendscouting event organised by E-foresight, Sabine Döbeli provided insights about key trends in sustainable finance. Visit the E-foresight homepage here.

Webinar Fokus Pensionskasse – VPS

With SSF being a knowledge partner for this VPS webinar series, Sabine Döbeli gave a presentation on sustainable investments for pension funds, for the November edition. Watch the recording here.

World Investment Forum – UNCTAD

Sabine Döbeli, in her role as a member of the UNCTAD Sustainable Investment Advisory Council, brought in the Swiss perspective in two panels in the International Sustainable Fund Conference and in the International Sustainable Finance Regulation Conference, both of which took place as part of the UNCTAD World Investment Forum (WIF) 2023.

SSF/ECOFACT TCFD-Disclosure Webinar: Guidance and Best Practice in the Swiss Context

From the financial year 2024, climate-related disclosure will become mandatory for some financial institutions, as require by the Swiss Code of Obligations and the Ordinance on Climate Disclosures. In August 2023, SSF and ECOFACT AG published a guidance for TCFD Disclosure in the Swiss context. This webinar was opened with a short introduction by SSF CEO, Sabine Döbeli, followed by a presentation outlining how the climate reporting can be implemented effectively to allow forward-looking strategic decision-making with Katja Brunner, Director Legal & Regulatory of SSF and Olivier Jaeggi, Managing Director of ECOFACT AG. In addition, Sébastian Soleille, Global Head of Energy Transition and Environment, BNP Paribas will provide insights on the practical implementation of the TCFD recommendations.

Building Bridges Action Days 2023

2023 marked the fourth edition of the Building Bridges (BB) Summit and Action Days, which gathers together players from the financial industry, NGOs, the real economy and academia.

SSF/AMAS Event: "Introducing the Swiss Stewardship Code" (4 October 11:00-12:30)

SSF and the Asset Management Association Switzerland (AMAS) jointly launched the Swiss Stewardship Code (SSC), which provides asset managers, asset owners and financial service providers with guidance to encourage the active exercising of shareholder rights by investors in Switzerland. After a welcome note by Adrian Schatzmann, CEO of AMAS, Daniela Stoffel, State Secretary for International Finance – Federal Department of Finance expressed her support for the code in a video statement. Antonio Carrillo, Group Head of Climate and Energy at Holcim, commented on investors as drivers for a corporate sustainability strategy. Katja Brunner, Director Legal & Regulatory Projects at SSF and Aurélia Fäh, Senior Sustainability Expert at AMAS, the two project co-leaders, presented the content of the Code . During a panel discussion moderated by Sabine Döbeli, CEO of SSF, Matthias Narr, Head Engagement International at Ethos Foundation, Ulla Enne, Head Responsible Investing and Investment Operations at Nest Sammlestiftung, Matteo Passero, Investment Stewardship Analyst at UBS, provided practical insights on implementation.

Read the full Swiss Stewardship Code here

SSF/SIFI Workshop: Idea Challenge - Solutions for Thriving Impact Investing Ecosystems (4 October, 10:00-11:00)

Co-hosted by SSF and the SDG Impact Finance Initiative (SIFI), this interactive workshop facilitated group discussions around actionable solutions towards creating more favourable conditions for the impact investing ecosystem. After an opening statement from Guillaume Bonnel, CEO of SIFI, Sabine Döbeli, CEO SSF, moderated a panel of international experts: Anne-Catherine Frogg Spadola, Board Member Swiss Philanthropy Foundation, Marnix Mulder, Director Market Development, Triple Jump BV (Netherlands), Arif Neky, Coordinator of the SDG Partnership Platform Kenya and Jason Van Staden, Project Manager Research and Training, Bertha Centre for Social Innovation and Entrepreneurship (South Africa). These opening remarks gave way to group discussions on the following four topics: strengthening collaboration and partnership between the various actors in the ecosystem, leveraging philanthropic organizations for impact investing, governments helping to mobilize private capital for impact investing and improving access to impact investments by private and institutional investors. At the end of the session, the participants could vote on the most pressing solutions. The two winning suggestions were the creation of an umbrella platform that can bring together different players to provide resources, education, expertise and technology to attract more capital towards impact investing globally and the need for reform of international financial institutions to make them less risk averse and provide more additionality to the private sector.

High Level Plenary: "How Much Does your Business Depend on Nature? Getting Ready for Nature-Related Financial Disclosures" (3 October, 9:00-9:45)

During the morning plenary session on 3 October, the Taskforce on Nature-Related Financial Disclosures (TNFD) was launched in Europe. Last year during Building Bridges, SSF and the UN Global Compact Network for Switzerland and Liechtenstein (UNGCSL) jointly announced their co-convening of the Swiss Consultation Group to the TNFD. Over the course of the past year, we have jointly held informational webinars and hosted a feedback workshop to provide the TNFD with the Swiss market’s perspective on nature and their framework. In his capacity as co-convenor of the Swiss Consultation Group, Antonio Hautle, Executive Director at UNGCSL, moderated a panel of experts at this session, featuring Emily McKenzie, Technical Director at TNFD, Renata Pollini, Head of Nature at Holcim, Alison Bewick, Global Head of Group Risk Management and Néstle, Judson Berkey, Lead Advocacy, Chef Sustainability Office at UBS and Nora Ernst, Senior Sustainability Risk Manager at Swiss Re. The framework aims to encourage businesses and financial players to include nature-related opportunities, risks, dependencies and impacts into their operations and risk assessment. As Judson said during the panel, “the financial sector can act as a vital catalyst” for the uptake of nature in such discussions and we at SSF agree!

SSF moderating at SIA Event: "The Role of Insurance in Promoting Sustainability"

In the face of the imperative for transition, sustainability is also becoming more prevalent in insurance underwriting, both as a source of risk and as a potential impact on the environment and society. Hendrik Kimmerle, Senior Project Manager at SSF, moderated a panel of experts at this event organised by the Swiss Insurance Association (SIA). We heard from the panelists: Linda Freiner, Group Head Sustainability at Zurich Insurance Group, Diana Diaz, PSI Programme Supervisor at UNEP FI, Florian Schreiber, Professor and Insurance Lead at IFZ, and Amandine Favier, Head of Sustainable Finance at WWF Switzerland, on the key barriers, opportunities and further actions to embed ESG in the underwriting process of insurance companies while. The discussion highlighted the need for international frameworks, collaboration and comprehensive ecosystems.

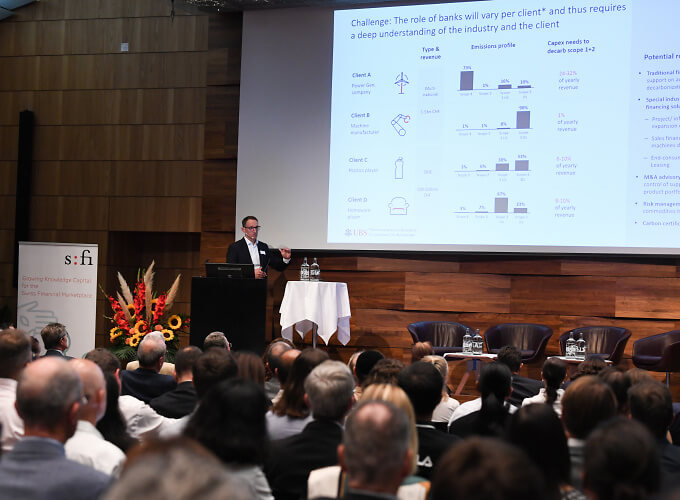

SFI–SSF Conference: Financial Innovation—Accelerating the Change

At this year’s SFI–SSF conference in Zurich, attended by over 200 participants, renowned figures from the financial industry and academia discussed and cast light on various aspects of the multi-layered sustainability universe.

Professor François Degeorge, Managing Director of SFI, opened the SFI–SSF conference, which this year explored "Financial Innovation—Accelerating the Change". Together with Sabine Döbeli, CEO of Swiss Sustainable Finance, Professor Degeorge answered opening questions from moderator Olivia Kinghorst.

Jared Bibler, Founder and Director of Katla, kicked off proceedings with an exciting keynote speech that focused on the financial system as a whole. Additionally, he exposed the audience to key facts and figures leading up to and following the 2008-2011 Icelandic financial crisis displaying the fragility of financial systems if appropriate checks and balances are not put in place and associated risks not taken into consideration. SFI Professor Zacharias Sautner, from the University of Zurich, then opened the thematic block "Climate Risk for Banks", before Eric Bonnin of Société Générale explained the role of the financial industry in the energy transformation phase of the green transition. The first part of the conference was brought to a close by Alfred Ledermann, Co-Head Sustainability at UBS, who highlighted the challenges but also the opportunities of the reorientation required of the banking sector.

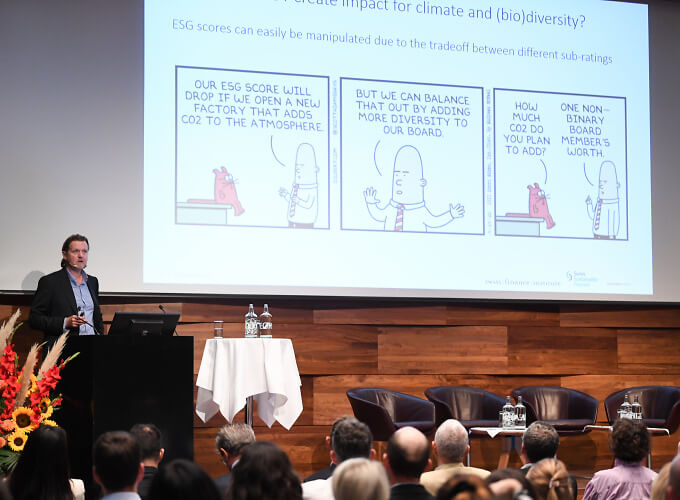

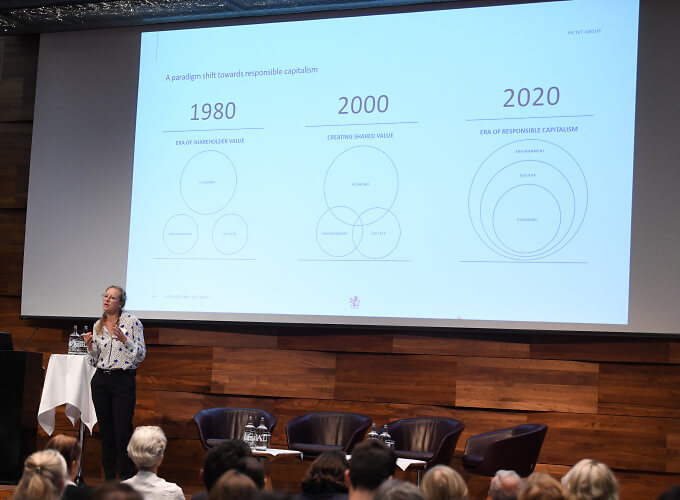

The second thematic block of the conference—entitled "Innovation and Impact"—was launched by SFI Professor Eric Nowak, from the University of Zurich, addressing the question of what influence the financial industry actually has on climate or biodiversity, focusing specifically on aspects around carbon offsets and the global carbon market. Rochus Mommartz, CEO of responsAbility, followed sharing his thoughts on the impact and scope of the emerging industrialization of sustainable finance, emphasizing that scaling existing solutions is key to achieving more impact. The block was rounded off by Marie-Laure Schaufelberger, Head of Group ESG & Stewardship at Pictet, who addressed the most important levers and challenges in the area of public markets. The final highlight of the conference was the energizing closing panel discussion, which featured Dr. Alexander Barkawi, Founder and Director of the Council on Economic Policies, Dr. Thomas Heinzl, Chief Financial Officer of Vontobel, and Johanna Preisig, Head of Strategic Services at FINMA. This panel provided a lot of heated food for thought for participants to debate over during the evening networking apero.

Swiss Sustainable Market Study 2023 Launch Webinar

On 27 June 2023, Swiss Sustainable Finance (SSF) published the 2023 edition of the Swiss Sustainable Investment Market Study during a launch webinar.

After an introduction from Sabine Döbeli, SSF CEO, and Patrick Odier, SSF President, the Market Study results were presented by Kelly Hess, Director Projects, SSF and Prof Timo Bush, University of Hamburg. The biggest change to the market study this year is the shift in terminology from sustainable investments to sustainability-related investments. This is in reaction to an advancing market becoming more complex and aims to contribute to ongoing discussions on defining sustainable investments. Accordingly, the methodology of the market study was refined. In the report, the CHF 1,610 billion of sustainability-related investments is viewed through three lenses: number of applied SI approaches, definition of AMAS self-regulation and pilot based on Eurosif white paper. Key conclusions are that there is growing demand for impact-related investments, that the distinction between company impact and investor impact is essential, that transparency on ESG/impact performance measurement needs more attention and that investments with higher ambition levels such as advanced ESG, impact-aligned and impact-generating (35%) have room to grow.

In the second half of the event, Katja Brunner, Director Legal & Regulatory, SSF, gave an overview of recent regulatory developments in Switzerland, such as the revision of the Swiss Code of Obligations, the use of TCFD for asset managers and activities from the Federal Council and FINMA. She also touched on EU developments, such as the SFDR, the CSDR and discussed related implementation challenges. The session ended with a Q&A.

SSF Annual Conference 2023: How to Accelerate the Transition

Around 220 people joined us at the Kursaal in Bern for the SSF Annual Conference 2023. After the afternoon was opened with a brief welcome note by Sabine Döbeli, SSF CEO, the first presentation was from Christoph Aeschlimann, Swisscom CEO, who shared how Swisscom takes responsibility for the environment by aiming to be a climate-neutral company by 2025 via 6 key levers; energy-efficient infrastructure, climate-friendly work, renewable energies, sustainable supply chain, sustainable mobility and CO2 capture and storage. He also shared the concept of a "handprint", which refers to developing digitalisation technologies such as smart working solutions, demateralisation, cloud services, circular economy, IoT technologies and innovative customer solutions, to reduce emissions in their business processes and customer experience. The primary role of finance he saw in financing such companies through venture capital, thereby strengthening economic opportunities for Switzerland.

The next session offered three presentations about credible transition plans. Tony Rooke, Executive Director and Head Transition Finance at GFANZ, explained how integral transition plans have to form a core element of a financial institution's strategic response to climate change and shared some key aspects that successful transition plans entail; objectives and priorities, an implementation strategy that aligns business activities, products and services with net-zero objectives, an strategy for engagement with external stakeholders, the correct governance structures to support the implementation and reliable and well-chosen metrics and targets. Stephanie Maier, Member of the Steering Committee of CA 100+ and Global Head of Sustainable and Impact Investment at GAM Investments, gave insights into how ClimateAction 100+ promotes credible transition plans and the importance of these for investors. Ruben Feldman, itBDep. Head of ESG Strategy & Business Development, Zürcher Kantonalbank ZKB, stressed that "time is running out and the time to act is now". In his presentation he put emissions reductions in a global context, stressing that the climate crises requires local responsibility and global collaboration and that nations like Switzerland import a lot of emissions through the products they consume.

After a short break, Daniela Stoffel, State Secretary - State Secretariat for International Finance (SIF), gave a speech on Switzerland's role in sustainable finance and to what extent market forces and business opportunities are enough to bring about market-led sustainability practices. For the final section of the afternoon, Reto Burkhard, Head of Climate Division, FOEN presented the Swiss climate strategy that is strengthened after the positive result of the vote on the law on climate an innovation, followed by Peter Bakker, President and CEO, WBCSD, who spoke about the importance of tackling inequities as a basis for effective climate action. The two speakers were in conversation with Patrick Odier, SSF President, about the various Swiss actors contributing to achieving the transition and the extent to which social issues must urgently be integrated into sustainability practice

Presentations:

- SSF slidedeck

- Tony Rooke slidedeck

- Stephanie Maier slidedeck

- Ruben Feldman slidedeck

- Reto Burkhard slidedeck

- Peter Bakker slidedeck

For training materials on transition planning and transition finance: https://www.gfanzero.com/workshops-in-a-box/

For full GFANZ publications: https://www.gfanzero.com/publications/

SSF Member Informational Webinar on the v0.4 TNFD Framework

At this webinar SSF and GCNLS presented the newest release of the TNFD framework version 0.4 and started the discussion with our network. After an introductory note by Antonio Hautle, Executive Director, GCNLS, Fabienne Sigg, Programme Manager, GCNLS and Veronica Baker, Project Manager SSF, were be joined by Alison Bewick, Taskforce Member and Head of Group Risk Management at Nestlé and Renata Pollini, Taskforce Member and Head of Nature at Holcim for a discussion of th v0.4 framework. The aim of this webinar was to give our network an understanding of the TNFD framework, why it is important, how it is evolving and what this will mean for financial and non-financial players in the coming year. The slides and a recording of the session are available in the members' section.

SSF/PRI Asset Owner Workshop: Embedding Sustainability in Manager Selection & Monitoring

In this workshop, Swiss asset owners came together to share experiences around manager selection/monitoring and illustrate helpful tools. During the workshop the PRI outlined common practices and shared specific tools already available to asset owners, and practitioners presented how they implement systematic processes for manager selection/monitoring. Participants engaged in a dialogue about their own views and experiences and dove deeper into the topic with practitioners facing similar issues. The event was rounded out by an apero for further exchanges.

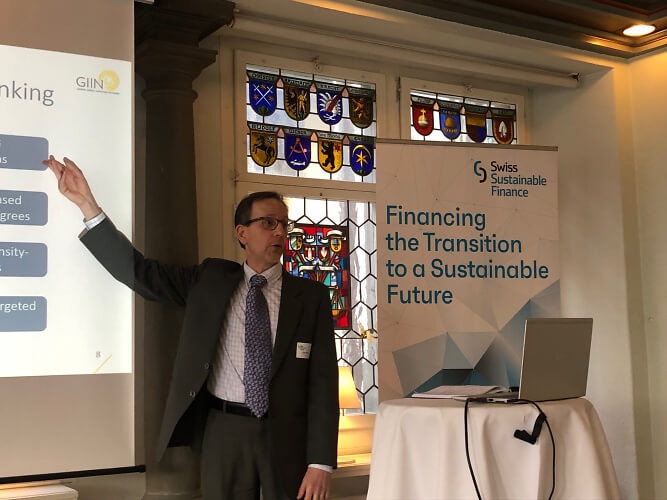

SSF/GIIN Asset Owner Workshop: Investing with an Impact Lens

At this workshop for Swiss asset owners, jointly organised by SSF and the GIIN, Sean Gilbert, Chief Investor Network Officer, GIIN, presented different approaches of how asset owners can integrate an impact perspective into their investment policies. Michael Haene, Investment Strategist, PKZH, (Pensionskasse der Stadt Zürich) illustrated the approach of PKZH which builds on active engagement in a passive portfolio, complemented by direct investments into affordable housing and renewable energy projects as well as the purchase of green, social and sustainable bonds. Grégoire Hänni, Chief Investment Officer, CPEG (Caisse de prévoyance de l'Etat de Genève) presented an innovative public private partnership project with the European Investment Fund (EIF) in which a fund of fund for VC investments into climate solutions is set up. In the subsequent interactive debate with the audience, best ways to integrate an impact lens to all asset classes – against the backdrop of limited resources – were discussed.

Members' Webinar: Science Based Targets (together with WWF Switzerland)

Members can access the webinar materials in the members' section of our website.