AI-Based Real Estate Portfolio Analysis

Challenge to overcome

For institutional investors, assessing the sustainability of real estate portfolios remains a significant challenge. Detailed information on the building stock of Real Estate funds remains scarce. There is a growing demand for reliable, transparent tools to evaluate the energy efficiency and carbon footprint of real estate holdings, as well as to assess the credibility of their decarbonation efforts.

A key objective of the initiative by Conser and ZHAW is therefore to examine whether the CO₂ reduction commitments and net-zero targets of real estate funds are realistic given the current condition of their building stock, and whether the required renovations are both achievable and aligned with reported measures.

Building on Conser's verification expertise, this initiative extends the ESG Consensus® methodology's principles of independence and transparency from equity & bonds fund-level sustainability claims to building-level assessments.

Machine-learning application / use case

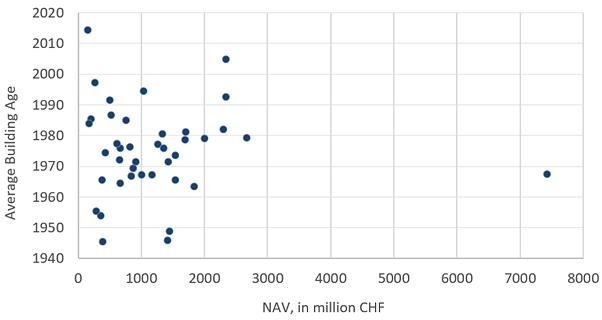

The first step in launching this joint initiative was to gather an overview of Swiss Real Estate funds included in the SXI Real Estate Funds Broad index. Many of these funds hold buildings with an average age exceeding 40 years, as shown in the below figure, suggesting a large share of the stock is approaching the stage where energetic refurbishments are necessary.

Swiss Real Estate Funds: Average Building Age vs. NAV

A large dataset of building-specific data was collected from several sources, including:

- GEAK (Gebäudeenergieausweis der Kantone), which includes detailed building and energy performance data for over 170,000 buildings in Switzerland,

- GWR (Gebäude- und Wohnungsregister), which provides information on heating system types and additional metrics.

The compiled database was used to estimate energy efficiency, obsolescence and projected carbon emissions through 2050.

Because U-values at the building level are not publicly available, they were estimated for various component parts. The U-value (also called thermal transmittance) indicates how well a building element conducts heat and serves as a key measure of thermal insulation quality.

For these estimates, various methodological approaches were applied, including a supervised machine learning model using Gradient Boosting Machines (GBM). The model was trained using the above combined dataset.

- Each building is assessed based on a life cycle assessment for various component building parts based on estimated U-values, with thresholds reflecting stages of technological advancement in energy efficiency. Buildings falling significantly behind the technological frontier are classified as obsolete, while those aligning with modern standards receive higher ratings. This positioning forms the basis of an "efficiency score" over time.

- The heating system of each building is evaluated based on its heating energy source and resulting estimated carbon emissions, resulting in a "heating score".

- A "composite obsolescence score" is then derived, combining envelope efficiency, heating system performance, and further building-specific metrics to provide a holistic view of overall energy performance.

- These scores are aggregated at the portfolio level, resulting in a transparent metric that reflects the obsolescence profile and CO2 emissions of an entire fund.

Use case key beneficiaries

☐ Relationship Managers

☒ Portfolio Managers

☒ Research teams, macroeconomists

☒ Control functions

☐ Support functions (HR, CFO, …)

☒ Other: Clients

Key benefits for the financial services sector

By putting the composite scores of each building and portfolio into perspective with the average renovation rate that is feasible for a Real Estate fund without compromising its economic viability (1 to 3% p.a.), the model enables portfolio managers and investors to anticipate forward-looking CO₂ emission trajectories, with projections calibrated up to 2050. These simulations provide insights into how well a fund’s current asset base aligns with its stated climate goals and to help identify renovation needs and decarbonization priorities. For Conser’s institutional clients, who already rely on ESG verification services, this initiative deepens sustainability coverage to the real assets underlying the financial instruments, offering a comprehensive view of sustainability across their Swiss real estate investment universe.

Supporting technology

The project employs supervised machine learning techniques, including Gradient Boosting Machine (GBM) model serving as one tool for predicting U-values over time. To ensure robustness, Bayesian Imputation and Sampling Theory were also applied to the dataset to cross-validate the GBM predictions, thereby enhancing confidence in the estimated results. This approach emphasises explainability and auditability, qualities that make the outputs accessible and trustworthy for investors.