AI-Driven Network Analysis to assess Carbon Markets integrity

Challenge to overcome

Carbon markets are systems that enable the trading of carbon emission allowances or credits, assigning a monetary value to greenhouse gas emissions in order to drive climate action. By incentivizing cost-effective emissions reductions, they help allocate resources toward the most efficient decarbonization solutions. Global carbon markets play a pivotal role in achieving the objectives of the Paris Agreement by facilitating cost-effective emissions reductions.

However, the credibility and the effectiveness of global carbon markets is increasingly undermined by the presence of "hot air" credits, which are emission certificates that do not correspond to real emissions reductions. These credits have the potential to distort price signals, mislead investors and ultimately risk slowing global climate progress (Betz et al. The Carbon market Challenge, https://www.cambridge.org/core/elements/carbon-market-challenge/9261122253200C956EAF02B5C9AF53C8).

The absence of transparency and verifiable data across carbon registries and projects serves to exacerbate this issue, thereby hindering regulators and market participants from identifying and avoiding such credits. The approval of the standards needed to operationalize Article 6.4 at COP29 in Baku, combined with recent signals from the European Commission on the possible future role of international certificates in EU climate policy, has renewed attention to strengthening the environmental integrity of international carbon trading mechanisms.

To address this, ZHAW is developing an AI-based network analysis tool designed to uncover governance weaknesses and systemic vulnerabilities, detect patterns of risk, and enhance market accountability. The objective of this initiative is to establish a foundation for carbon markets that is more credible, with the aim of aligning financial flows with meaningful climate action.

AI application / use case

In order to address the persistent issue of carbon market integrity, ZHAW is developing a state-of-the-art, AI-based network analysis framework. The objective of this framework is to trace carbon credit flows, detect anomalies, and identify key intermediaries involved in the circulation of so-called "hot air" credits. This model synthesizes diverse trading and organizational datasets to map complex trading networks, reveal high-impact actors, and quantify the influence of countries, sectors, and organizations on carbon market dynamics.

The framework operates across multiple analytical layers. The study's initial approach utilizes regression techniques and network analysis to trace the movement of emission reduction units (ERUs) from issuance to utilization within compliance markets, such as the Swiss and the EU emissions trading system (ETS). This approach provides profound insights into the behaviors and structures that enable the circulation of low-quality credits, thereby exposing the weaknesses in current market governance.

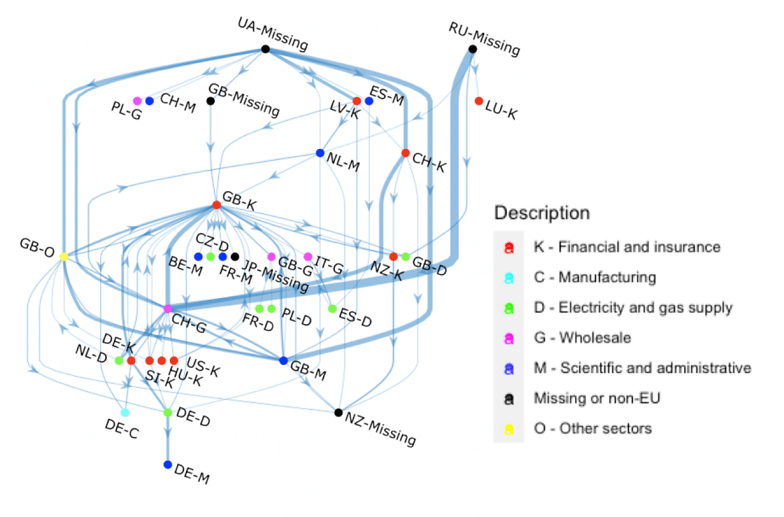

A key strength of this initiative is its ability to combine data from various, often disconnected sources, such as the EU registry and national registries from Switzerland, Ukraine, and Russia. This enables the creation of detailed, cross-border datasets that uncover major trading patterns and weaknesses in the system. The network analysis uncovers critical trading pathways and systemic vulnerabilities in the global carbon market, emphasizing the influential role of financial intermediaries and commodity traders. The analysis indicates that Swiss financial and commodity trading entities, particularly those in the oil and gas sector, along with insurance and financial firms in the UK, play a central role in moving ERUs through the market which includes "hot air" credits that often originate from Russia and Ukraine . The findings reinforce the importance of enhancing transparency and accountability in carbon trading, addressing systemic risks, and the need for enhanced market oversight.

The project delivers significant value to the governance of the carbon market. It identifies high-risk patterns and systemic vulnerabilities, offers a replicable methodology for other emerging mechanisms and supports SDG 13 by improving emissions tracking and reinforcing compliance systems.

As carbon markets evolve and assume a more pivotal role in climate finance, it becomes imperative to ensure the integrity of these systems. ZHAW's initiative exemplifies the potential of advanced analytics to strengthen the integrity, transparency, and alignment of carbon markets with global climate objectives. The project's contribution to the development of a robust, credible, and sustainable carbon trading ecosystem is predicated on the provision of actionable insights to policymakers, regulators, and financial actors.

Source: Kotsch et al., Network Analysis of the Global Trade of "Hot Air": Key Lessons for the Paris Agreement, 2024 (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5038486)

AI use case key beneficiaries

☐ Relationship Managers

☐ Portfolio Managers

☐ Research teams, macroeconomists

☒ Control functions

☐ Support functions (HR, CFO, …)

☐ Other: Clients

Supporting technology

The project applies advanced anomaly detection methods, including unsupervised learning algorithms such as clustering and isolation forests, to identify irregularities and risk patterns in carbon trading transactions where labelled data is scarce.

In parallel, ZHAW employs graph-based modelling to represent global carbon markets as interconnected networks, with entities (sellers, buyers, and intermediaries) as nodes and certificate transfers as edges. By analysing network metrics such as centrality and clustering, the framework can reveal hidden dependencies, concentrated market power, and circular trading loops.

Together, these methods enable the detection of systemic vulnerabilities ranging from high-risk intermediaries and speculative bubbles to the movement of credits with questionable environmental integrity into compliance markets. The insights generated provide regulators, market actors, and policymakers with data-driven tools to enhance oversight, mitigate risks, and strengthen trust in international carbon markets.

Benefit of the AI use case for the financial services sector

The project delivers significant value to the governance of the carbon market. It identifies high-risk patterns and inefficiencies, offers a replicable methodology for other emerging mechanisms and supports SDG 13 by improving emissions tracking and reinforcing compliance systems.

As carbon markets evolve and assume a more pivotal role in climate finance, it becomes imperative to ensure the integrity of these systems. ZHAW's initiative exemplifies the potential of advanced analytics to ensure the efficiency, transparency, and alignment of carbon markets with global climate objectives. The project's contribution to the development of a robust, credible, and sustainable carbon trading ecosystem is predicated on the provision of actionable insights to policymakers, regulators, and financial actors.