AI-powered Investment Due Diligence

Challenge to overcome

Portfolio Managers and Investment Analysts are under pressure to interpret increasingly complex datasets and articulate compelling and differentiating narratives about risks, opportunities, and impact.

They must quickly assess the sustainability performance of a potential portfolio company ahead of an investment decision or an upcoming investment committee meeting, for example. The challenge is not just the volume of data but its complexity, and the need to translate it into actionable insights under time pressure.

AI application / use case

Clarity AI has developed AI-powered tools to help investment management teams in this process, with a focus on providing efficiency gains in data aggregation, curation, and preliminary assessment.

The "Company Briefs" serve as an AI-powered co-pilot for investment teams. The brief begins with a one-page snapshot of the target company’s ESG standing, integrating visual metrics and a high-level narrative to highlight the most material strengths and risks. The Brief then provides focused insights on the most critical issues for the company, whether those are areas of strong performance or potential red flags.

Investment management teams can get more granular insights behind each data points from the one-pager: the tool provides then contextual narratives benchmarked against industry peers, focused analysis on key ESG topics, an in-depth review of climate transition strategies (including target credibility, progress, and alignment with global goals), or a comprehensive summary and analysis of controversies affecting the company.

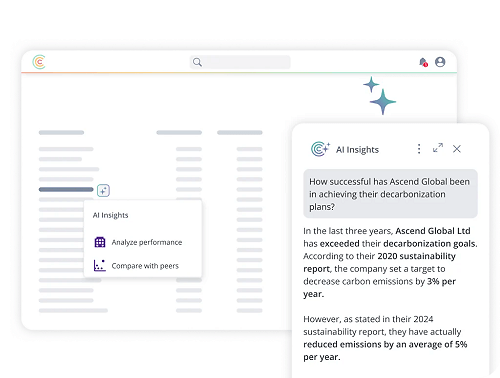

If questions remain, investment teams can turn to the "AI Assistant", an interactive chatbot that provides real-time answers grounded in the same data. Using natural language queries, the user can ask questions like "How does this company’s Scope 1 and Scope 2 emissions compare to its peers over the last three years?" or "Summarize recent controversies related to environmental practices." From clarifying metrics to exploring peer trends, the Assistant ensures that no critical detail is missed.

Use case key beneficiaries

☒ Relationship Managers

☒ Portfolio Managers

☒ Research teams, macroeconomists

☒ Control functions

☐ Support functions (HR, CFO, …)

Benefits of AI use case for financial services sector

The Company Briefs, complemented with the AI Assistant, allows investment teams to navigate large volumes of complex data in a rapid, trustworthy and user-friendly manner. The dynamic data sourcing (see below) allows that the Company Briefs are always based on the most recent available information.

This supports investment teams in achieving significant efficiency gains, and ensures investment decisions and recommendations are based on high-quality, up-to-date data on demand, without having to wait for a new batch of third-party analyst reports.

Supporting technology

Clarity AI’s tools leverage a blend of Large Language Models (LLMs) that have been adapted to specialize in targeted types of sustainability analysis. They leverage an inhouse data platform, established with carefully curated data from various sources and providers, in order to build a core reliable data foundation for all models.

Agentic AI orchestration

The tools operate like a virtual sustainability team, built on a multi-agent system powered by LLMs.

At its core, the system consists of specialized expert agents, developed to handle specific tasks. These agents access Clarity AI’s proprietary curated dataset and/or public information, according to each specific task being performed.

Overseeing the process is an orchestrator agent that coordinates the experts, ensuring seamless collaboration and producing high-quality outputs. The system dynamically selects the most suitable LLMs for each task, thereby optimizing performance while maintaining speed and reliability.

Dynamic data sourcing

The tool ingests structured datasets, such as carbon emissions and ESG scores, alongside unstructured data like sustainability reports and public statements. It automatically standardizes and integrates this information, eliminating the need for manual data wrangling.

Yet the datasets that LLMs learn from are static snapshots of the public internet and can quickly become outdated. To bridge that gap, Clarity AI equips each model with a curated set of "tools": secure application programming interfaces (APIs) and database queries that fetch live, authoritative data on demand. The agentic orchestration layer decides when to invoke each tool, pulls the latest results, and feeds them back to the model. This loop ensures the AI-powered reports are both context-rich and current.

LLM as a judge

Reliability is of the utmost importance, and that is why the end-to-end process undergoes rigorous validation, with dozens of automated checks to guarantee consistency, accuracy, and compliance. On top of the generation layer, we also apply what is known as "LLM-as-a-Judge": the use of one LLM to evaluate, validate, or backtest the outputs of another. The judge cross-examines and reviews each brief before it reaches the user. This end-to-end process happens within seconds, and leverages the guidelines set by humans so that the AI evaluator performs accurately.