Past SSF Events 2021

Select an event in the table below and find out more about the events SSF organised in 2021.

| Date | Event | |||

| 1 December |

Roadmap Launch at Building Bridges: Roadmap for Key Swiss Financial Market Players |

|||

| 29 November - 1 December | Building Bridges 2021: 3 SSF Events | |||

| 5 / 12 November 2021 | SSF Annual Forum for Sustainable Finance Education in Geneva and Zurich | |||

| 6 October 2021 | ZHAW and SSF Event: Novel Data Solutions | |||

| 31 August 2021 | SSF Member Webinar: How to Implement the SSF Transparency Recommendations | |||

| 22 June 2021 | SSF Annual Conference: Credibility through Transparency | |||

| 7 June 2021 | Launch Webinar of Swiss Sustainable Investment Market Study 2021 | |||

Roadmap Launch at Building Bridges: Roadmap for Key Swiss Financial Market Players

Swiss Sustainable Finance (SSF) presented its private sector Roadmap to a sustainable financial centre Switzerland. The announcement was made by Patrick Odier, SSF President and Sabine Döbeli, SSF CEO.

Access the dedicated microsite for the publication here.

Building Bridges 2021: 3 SSF Events

Sustainable Finance Technology Workshop on Novel ESG Data Solutions (30.11.)

Shedding Light on the ESG Jungle (1.12.)

- Livestreaming here

Scaling Private Investments for Impact - Success Factors for Private-Public Collaboration (1.12.)

- Livestreaming here

- Slide Deck from Tim Radjy, Chairman, AlphaMundi Group Ltd, here

- Slide Deck from Gregoire Haenni CIO, Caisse de Prévoyance de l'Etat de Genève (CPEG) here

Read a full SSF Summary of Building Bridges here.

SSF Annual Forum for Sustainable Finance Education

This event was held on 5 November 2021 in Geneva in French and on 12 November 2021 in Zurich in German. The aim was to bring together professionals from the sustainable finance education field and featured many members of the SSF team highlighting SSF work within the field of Education. In addition, the new SSF page on the Evrlearn platform was unveiled. View all the presentations from both locations here.

Geneva:

- SSF Presentation featuring Alberto Stival, Representative Ticino and Director Educational Development, Jean Laville, Deputy CEO and Katja Brunner, Director Legal and Regulatory Projects.

- Education à la finance durable au regard de l'évolution de la politique environnementale en Suisse from Karine Siegwart, Vice-Directrice, Office Federal de l'Environnement OFEV.

- Green and Sustainable Finance Education Presentation from Simon Thompson, Chartered Banker Institute.

- Haute école de gestion (HEG) Genéve slides from Antoine Mach, Managing Partner Covalence SA, Co-founder Sustainable Finance Geneva.

- Institute Supérieur de Formation Bancaire (ISFB) from Frédéric Kohler, Director ISFB.

- Swiss Banking Slides from Edouard Cuendet, Directeur, Fondation Genève Place Financière.

Zurich:

- SSF Presentation featuring Alberto Stival, Representative Ticino and Director Educational Development, Sabine Döbeli, CEO and Katja Brunner, Director Legal and Regulatory Projects.

- Sustainable Finance Bildung und umweltpolitische Entwicklungen in der Schweiz from Susanne Blank, Department Head Economics and Innovation, Bundesamt für Umwelt BAFU.

- Green and Sustainable Finance Education Presentation from Simon Thompson, Chartered Banker Institute.

- AZEK slides from Marianne Bonato, Member of the Executive Board, AZEK (Swiss Training Centre for Investment Professional).

- Centro Studi Villa Negroni (CSVN) slides from Helen Tschümperlin Moggi, CFA, Head of Finance Area.

- Swiss Banking Slides from Dr. Alexandra Steinberg, Head of Education Development, Swiss Banking.

ZHAW and SSF Event: "Novel Data Solutions"

At this physical event in Zürich, SSF and ZHAW co-hosted an all day event that included speakers from one of three thematic topics; Textual information and Natural Language Processing, Spatial Solutions and Life Cycle Assessment (LCA) and Others.

View the conclusions from this event here.

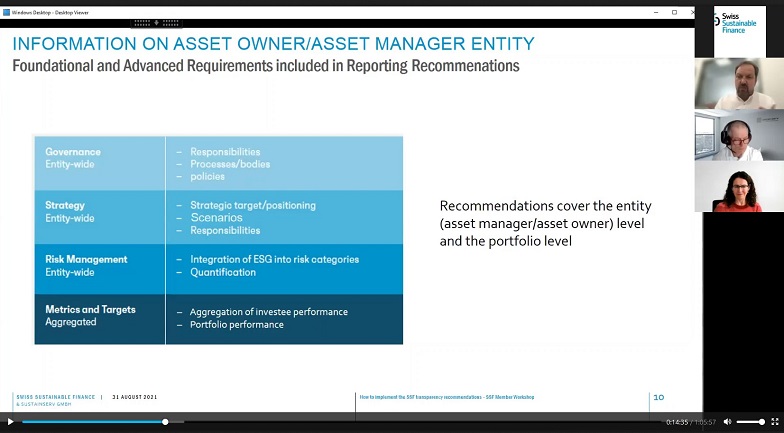

SSF member webinar: How to Implement the SSF Transpareny Recommendations

SSF, in collaboration with Sustainserv, hosted a webinar for members and network partners on SSF's recently published Reporting Recommendations on Portfolio ESG Transparency. The reporting recommendations were presented in detail an two concrete examples of a pilot test were presented by Nest and Vontobel. A recording of this webinar is available in the members section of the SSF website.

SSF Annual Conference: Credibility through Transparency

Hybrid conference, 22 June 2021

This year’s Annual Conference took place as a virtual event, broadcasted from Kursaal in Bern with over 250 online viewers. The newly elected SSF president Patrick Odier, opened the conference and welcomed Keynote speaker Magali Anderson, Chief Sustainability and Innovation Officer and Member of the Executive Board, LafargeHolcim Ltd. to the stage. In the course of her presentation, she illustrated the challenge of reducing the carbon intensity of the cement business, scaling-up low-carbon solutions, and providing adequate reporting and transparency. Despite being very time-consuming, adequate climate report is paramount for working and engaging with shareholders and bringing the company forward.

After these inputs, Kelly Hess gave an introduction on SSF’s newest publication, the Reporting Recommendations on Portfolio ESG Transparency, which is the result of a fruitful collaboration between SSF’s asset owner and asset manager workgroups. Ralf Frank, Senior Advisor, Sustainserv, and lead author of the report, presented the document and explained how the recommendations cover both the issuing entity level and the portfolio asset level, and can be used to comparably and efficiently report on portfolio ESG aspects. He outlined how the recommendations include both a fundamental and advanced reporting level for those starting out and those already experienced, respectively. The recommendations are based on an extensive analysis of existing frameworks and are meant to be tested by industry players in the next few months and were designed in a way to be adaptable to the ever-changing regulatory landscape.

During second part of the afternoon, Sabine Döbeli, CEO, SSF, moderated a diverse and very engaging panel that discussed how trust and transparency within the financial industry can and must be increased. Antoinette Hunziker-Ebneter, CEO Forma Futura Invest & President of the Berner Kantonalbank, highlighted that a concise and well-anchored sustainability analysis framework, both in the investment and lending business, is necessary for trust and credibility. The group also discussed current climate policy developments, with Thomas Vellacott, CEO, WWF Switzerland, pointing out that the rejection of the CO2 law clearly is not conducive to Switzerland’s ambition of becoming a leading sustainable financial centre. Nonetheless, financial industry players need to move fast to integrate sustainability in a credible manner, since pressure from the regulatory side will not subside. Regarding the position of Switzerland in sustainable finance, Stephen Nolan, Managing Director, FC4S pointed out that the Swiss financial centre already performs quite well, compared to its peers. However, in his opinion, further increasing education and capacity building will be crucial going forward. From the perspective of the government and regulator, Christoph Baumann, Deputy Head Insurance & Risks, State Secretariat for International Finance SIF, also sees a clear need for capacity building and enhanced transparency within financial institutions. In addition, working against fragmentation on disclosures, both in Switzerland and internationally, is a key priority of the Swiss government. Rounding off the discussion, almost all panel participants cited the importance for SSF to come up with clearly formulated “Roadmap” for the Swiss financial centre to generate concrete action, a document that is notably already in preparation.

Patrick Odier closed the afternoon, thanking all the participants and speaker for their attendance, and stated that in the name of SSF, he looks forward to working on these topics in the future as the newly appointed President.

>Download Magali Anderson's (LafargeHolcim) slides

>Download full SSF report (English) or summary (German, French)

Launch of Swiss Sustainable Investment Market Study 2021

Webinar, 7 June 2021

On the 7th of June 2021, Swiss Sustainable Finance (SSF) published the Swiss Sustainable Investment Market Study 2021 and launched the publication during a live webinar with an audience of almost 400 viewers on Zoom and Youtube.

After a welcome note by the SSF president Jean-Daniel Gerber reflecting on the increasing trend of sustainable investment he has observed during his 6 years in office, Kelly Hess, Director Projects, SSF, presented the key findings of this year’s market study, which again saw double digit growth in sustainability investing in Switzerland.

Prof. Timo Busch, Senior Fellow at the CSP UZH and Professor at the University of Hamburg, provided an academic overview on these results, highlighting the key engagement themes observed in the market. He also delved more deeply into the notion of impact, and explained how various asset classes can be seen to have impact and that it is important to differentiate between impact-aligned and impact-generating investments. More on that topic can be read in the various academic articles coming from the CSP.

Next, Anja Bodenmann, Project Manager, SSF, outlined the most important regulatory and a policy developments on sustainable finance in the past year, focusing in particular on the measures put forward by the Swiss government. This was followed by Victor van Hoorn, Executive Director, Eurosif, who explained the different elements of EU regulation in more detail, highlighting how the Sustainable Finance Disclosure Regulation (SFDR) is becoming an increasingly common denominator, and mentioning the most recent discussions around further development of the EU Taxonomy. Victor also addressed the Markets in Financial Instruments Regulation (MiFID II) and the EU Ecolabel, as well as some expectations for the EU’s upcoming Renewed Sustainable Finance Strategy.

During the last part of the webinar, moderated by Sabine Döbeli, CEO, SSF, panelist took up many interesting question from an engaged audience and closed to webinar outlining important next steps for the Swiss sustainable finance market and SSF.

>View interactive executive summary online (microsite)

>Download full market study (English) or summary (German, French)